SIST EN 16992:2017

(Main)Competency for Customs Representatives

Competency for Customs Representatives

This European Standard aims at providing, in accordance with the EU legislation, competency requirements for customs representatives.

Kompetenzanforderungen für Zollvertreter

Diese Europäische Norm bezweckt die Festlegung von Kompetenzanforderungen für Zollvertreter in Übereinstimmung mit der Gesetzgebung der Europäischen Union.

Compétences des représentants en douane

La présente Norme européenne vise à spécifier des exigences de compétences applicables aux représentants en douane, conformément à la législation de l'Union européenne.

Usposobljenost carinskih zastopnikov

Cilj tega evropskega standarda je, da v skladu z zakonodajo EU zagotovi zahteve za usposobljenost carinskih zastopnikov.

General Information

- Status

- Published

- Public Enquiry End Date

- 31-Jul-2016

- Publication Date

- 05-Feb-2017

- Technical Committee

- I11 - Imaginarni 11

- Current Stage

- 6060 - National Implementation/Publication (Adopted Project)

- Start Date

- 03-Feb-2017

- Due Date

- 10-Apr-2017

- Completion Date

- 06-Feb-2017

Overview

EN 16992:2017 - Competency for Customs Representatives is a CEN European Standard that defines competency requirements for persons and organisations performing customs representation services in line with EU legislation (Union Customs Code, UCC). The standard translates the EU Customs Competency Framework (EU-CCFW) into a practical competency model to promote transparency, harmonisation and compliance across EU Member States. It is intended to support AEO‑C criteria and to be used by certification bodies, customs representatives, and organisations involved in customs operations.

Key topics and technical requirements

- Scope and purpose

- Defines competency requirements for customs representatives acting under customs legislation (UCC, Article 18).

- Supports mutual understanding of roles, transparency and shared terminology across the EU.

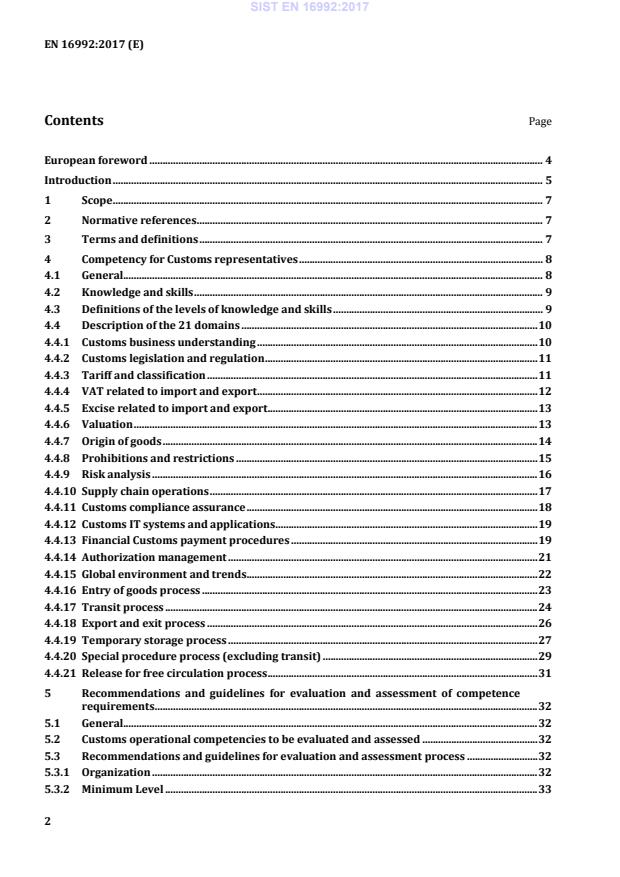

- 21 competency domains

- The standard details 21 domains of operational competency, including: Customs business understanding; Customs legislation and regulation; Tariff and classification; VAT and excise related to import/export; Valuation; Origin of goods; Prohibitions and restrictions; Risk analysis; Supply chain operations; Customs IT systems; Financial payment procedures; Authorization management; Transit, export, entry and special procedures; Release for free circulation; Temporary storage; and more.

- Knowledge and skills

- Each domain is described with required knowledge and skills aligned to customs law, IT systems and operational practices.

- Proficiency levels

- EN 16992:2017 defines four proficiency levels to grade competency. The published extract documents Level 1 (Awareness), Level 2 (Trained) and Level 3 (Advanced), outlining expected capabilities (from understanding concepts to applying complex processes and managing operations).

- Assessment guidance

- Clause 5 provides recommendations for evaluation and assessment: organizational arrangements, minimum proficiency levels, assessment schemes and an evaluation framework to support certification and internal competency assurance.

Applications and who should use it

- Customs representatives and customs brokers - to structure qualifications, job profiles and training curricula.

- Logistics and freight forwarders - to ensure staff meet competency requirements for customs formalities.

- Certification bodies and auditors - to assess compliance with AEO‑C criteria and issue competency-based certifications.

- Trainers, HR and compliance teams - to design assessment schemes, competency matrices and continuing professional development aligned with EU law.

- Customs authorities and importers/exporters - to set expectations for outsourced customs representation and verify service provider capabilities.

Related standards and frameworks

- Union Customs Code (UCC) - legal basis referenced throughout the standard.

- EU Customs Competency Framework (EU‑CCFW) - primary source underpinning EN 16992.

- AEO (Authorized Economic Operator) criteria - EN 16992 supports meeting AEO‑C competency expectations.

EN 16992:2017 is a practical tool to harmonise customs competency across the EU, helping organisations demonstrate compliant, auditable and consistent customs representation services.

Frequently Asked Questions

SIST EN 16992:2017 is a standard published by the Slovenian Institute for Standardization (SIST). Its full title is "Competency for Customs Representatives". This standard covers: This European Standard aims at providing, in accordance with the EU legislation, competency requirements for customs representatives.

This European Standard aims at providing, in accordance with the EU legislation, competency requirements for customs representatives.

SIST EN 16992:2017 is classified under the following ICS (International Classification for Standards) categories: 03.080.99 - Other services; 03.160 - Law. Administration. The ICS classification helps identify the subject area and facilitates finding related standards.

SIST EN 16992:2017 is available in PDF format for immediate download after purchase. The document can be added to your cart and obtained through the secure checkout process. Digital delivery ensures instant access to the complete standard document.

Standards Content (Sample)

2003-01.Slovenski inštitut za standardizacijo. Razmnoževanje celote ali delov tega standarda ni dovoljeno.Usposobljenost carinskih zastopnikovKompetenzanforderungen für ZollvertreterCompétences des représentants en douaneCompetency for Customs Representatives03.160Pravo. UpravaLaw. Administration03.080.99Druge storitveOther servicesICS:Ta slovenski standard je istoveten z:EN 16992:2017SIST EN 16992:2017en,fr,de01-april-2017SIST EN 16992:2017SLOVENSKI

STANDARD

EUROPEAN STANDARD NORME EUROPÉENNE EUROPÄISCHE NORM

EN 16992

January

t r s y ICS

r uä r z rä { {â

r uä s x r English Version

Competency for Customs Representatives Compétences des représentants en douane

Kompetenzanforderungen für Zollvertreter This European Standard was approved by CEN on

t w October

t r s xä

egulations which stipulate the conditions for giving this European Standard the status of a national standard without any alterationä Upætoædate lists and bibliographical references concerning such national standards may be obtained on application to the CENæCENELEC Management Centre or to any CEN memberä

translation under the responsibility of a CEN member into its own language and notified to the CENæCENELEC Management Centre has the same status as the official versionsä

CEN members are the national standards bodies of Austriaá Belgiumá Bulgariaá Croatiaá Cyprusá Czech Republicá Denmarká Estoniaá Finlandá Former Yugoslav Republic of Macedoniaá Franceá Germanyá Greeceá Hungaryá Icelandá Irelandá Italyá Latviaá Lithuaniaá Luxembourgá Maltaá Netherlandsá Norwayá Polandá Portugalá Romaniaá Serbiaá Slovakiaá Sloveniaá Spainá Swedená Switzerlandá Turkey and United Kingdomä

EUROPEAN COMMITTEE FOR STANDARDIZATION COMITÉ EUROPÉEN DE NORMALISATION EUROPÄISCHES KOMITEE FÜR NORMUNG

CEN-CENELEC Management Centre:

Avenue Marnix 17,

B-1000 Brussels

t r s y CEN All rights of exploitation in any form and by any means reserved worldwide for CEN national Membersä Refä Noä EN

s x { { tã t r s y ESIST EN 16992:2017

Proficiency levels . 36 Bibliography . 37

Note 1 to entry: Knowledge is the body of facts, principles, theories and practices that is related to a field of work or study [SOURCE: European Qualification Framework] 3.1.5 person natural person, and a legal person or any other association of persons which is not a legal person, but which is recognized under Union or national law as having the capacity to perform legal acts [SOURCE: Union Customs Code, Article 5(4)] 3.1.6 skill ability to apply knowledge and use know-how to complete tasks and solve problems [SOURCE: European Qualification Framework] SIST EN 16992:2017

CIM International Convention concerning the Carriage of Goods by Rail CITES Convention on International Trade of Endangered Species CMR Convention on the Contract for the International Carriage of Goods by Road DTS Declaration for Temporary Storage DV 1 Declaration of Value ECS Export Control System EIDR Entry Into the Declarant's Records EMCS Excise Movement and Control System ICAO International Civil Aviation Organization ICS Import Control System IMO International Maritime Organization IPR Convention on the Intellectual Property Rights MCQ Multiple Choice Questionnaire OLAF European Anti-Fraud Office SAD Single Administrative Document SASP Single Authorization for Simplified Procedures TARIC Integrated tariff of the European Community TIR International Road Transports TRACES Trade Control and Expert System UCC Union Customs Code 4 Competency for Customs representatives 4.1 General The activity carried out by a customs representative is to offer customs representation services for all the domains of customs legislation. As such, a customs representative shall comply with the EU and national customs legislation and customs related requirements. Compliance shall be permanently observed and monitored and where necessary procedures shall be adapted to new regulatory developments and circumstances. The person assessed shall be assessed on all 21 domains. A customs representative shall make sure that all internal and external stakeholders are well informed of their respective roles. SIST EN 16992:2017

B -“TRAINED LEVEL” LEVEL 2 ASSESSED SKILLS AND CAPACITIES: Standard requirement when a task requires this competency (to actually perform the task). — Applying relevant concepts and executing complex processes in daily work. — Apart from being able to perform the job, is able to draft and maintain detailed documentation and

use the appropriate IT systems for reporting and updating. — Knowing when and to whom to refer to with regard to operational issues. — Assessing risks, identifying trends and opportunities and making recommendations for improving

processes, policies and procedures. — Explaining and demonstrating the application of concepts to others. — Keeping in mind the safety and security issues and key points.

C - “ADVANCED LEVEL” LEVEL 3 ASSESSED SKILLS AND CAPACITIES: — Applying advanced knowledge to manage daily work and processes. — Having deep understanding of the competency at hand and how it is related to and impacts on

one’s own tasks as well as others. — Being able to monitor and lead staff in the application of the competency where required. — Being able to lead a team, supervise, or provide direction to junior staff while maintaining own

functional responsibility.

Have a high level understanding of customs processes and how they are interlinked; Examples given: 1) Definitions; 2) Customs representation; 3) Authorized Economic Operator; c) Understand the business drivers; d) Cooperate with customs and other relevant regulators; Examples given: 1) Communicate with the head or the stakeholders of the competent customs office taking or giving information or other data related to daily activities; 2) Communicate with the head or the stakeholders of agencies involved in the surveillance of the import or export of goods; e) Ensure compliance with the AEO rules. f) Understand macroeconomics and microeconomics related to a national, EU and global context. SIST EN 16992:2017

Apply the rules of circulation of relevant products in the EU; Example given: 1) Required documentation for importing/exporting goods under excise duty suspension; e)

Use EMCS or the system that interfaces with EMCS. 4.4.6 Valuation This section deals with the customs value of goods. A customs representative shall possess the knowledge and skills needed to: a) Be able to apply legislation governing customs value in practical work situations; Examples given: 1) Elements which must be included or not in the customs value; 2) Completion of the document detailing the customs value (DV1); 3) Documents to be used to support the declared customs value; 4) Advice on value; 5) Rules applicable for valuation (similar goods, deductive method, fall-back method); b) Have working knowledge of customs valuation rules and calculation methods; Examples given: 1) Elements which must be included or not in the customs value; SIST EN 16992:2017

Identify categories of P&R (Picket and Rail) goods such as product safety and consumer products, counterfeit and pirated goods, agricultural products, live animals, pharmaceuticals, drugs, vaccines, etc. in daily operations; Examples given: 1) Keeping an index of prohibited or restricted goods by using the TARIC; 2) Monitoring a constant survey of regulations and updates; c) Detect potential non-compliance by using government systems to ensure that non-compliant goods are not shipped; Examples given: 1) The low price of goods with a brand name can mean that the goods are counterfeit; 2) The description of a pharmaceutical product can lead to a drug precursor; d) Communicate with the relevant authorities involved and check any license as requested in the procedure; e) Keep appropriate file including separate authorization (permanently or per case authorization). SIST EN 16992:2017

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.

Loading comments...