CEN/TR 16931-4:2017

(Main)Electronic invoicing - Part 4: Guidelines on interoperability of electronic invoices at the transmission level

Electronic invoicing - Part 4: Guidelines on interoperability of electronic invoices at the transmission level

This Technical Report recommends a set of Guidelines to ensure interoperability at the transmission level to be used in conjunction with the European Norm (EN) for the semantic data model of the core elements of an electronic invoice and its other associated deliverables. The Guidelines are by nature non-prescriptive and non-binding.

These Guidelines take into account the following aspects:

1) recommending best practices for use at the transmission level;

2) supporting interoperability between all the parties and systems that need to interact and within the various operating models in common use;

3) ensuring a level playing field for the various operating models and bi-lateral implementations and for the use of existing and future infrastructures, which support e-Invoicing;

4) promoting a common terminology and non-proprietary standards for transmission and related areas;

5) ensuring the authenticity of origin and integrity of electronic invoice content;

6) providing guidance on data protection, on the enablement of format conversion, and on e-invoice legibility, including the use of a readable visual presentations, as required;

7) providing guidance for identification, addressing and routing;

8) identifying requirements for robust legal frameworks and governance arrangements;

9) recognizing the roles of trading parties, solution and service providers and related infrastructure providers.

The Objectives of the Guidelines are:

10) to support the implementation of the EU Directive 2014/55/EU on e-Invoicing and the core invoice model;

11) to propose best practices and recommendations for standards to enable electronic exchange of e-Invoices and related data between participants by providing a basis for interoperability at the transmission level, based on common requirements and scenarios;

12) to facilitate Straight Through Processing (STP) by the key actors in the supply chain (Buyers, Sellers, Tax Authorities, Agents, Banks, Service and Solution Providers, etc.);

13) to provide a set of non-prescriptive and non-binding Guidelines and recommendations that are applicable to all common operating models for e-invoice exchange and transmission whilst also providing recommendations specific to each of the common operating models.

To accomplish these objectives, the Guidelines are based on the following Requirements and Guiding Principles:

14) the need to cover the transmission of e-invoices and related documents from the system of the sending trading party to the system of the receiving trading party, including transmission issues for any intermediary platforms;

15) the need to allow any seller in any European (EU, EEA and Switzerland) country to deliver invoices to any buyer in any location in another European country (EU, EEA and Switzerland);

16) the need to support all common invoicing processes and modes of operation;

17) the need to be compatible with the current legislative and regulatory environment for the exchange of e-Invoices and related data;

18) the need to support the European Norm and other commonly accepted content standards;

19) the need to ensure that other document exchanges beyond e-Invoicing can be supported;

20) the need to establish clear boundaries between the collaborative and competitive domains;

21) the need to enable competition between business models, solutions and service providers and foster innovation;

22) the need to ensure that European supply chains remain an integrated and competitive part of the global economy;

23) the need to promote network effects leading to the development of critical mass as e-Invoicing becomes the dominant mode of invoicing (network effects result in a service becoming more valuable as more trading parties use it, thus creating a virtuous circle and further momentum for adoption).

The following items are considered to be in the competitive domain and therefore out of scope of the Recommendations:

(....)

Elektronische Rechnungsstellung - Teil 4: Leitfaden über die Interoperabilität elektronischer Rechnungen auf der Übertragungsebene

Facturation électronique - Partie 4: Lignes directrices relatives à l’interopérabilité des factures électroniques au niveau de la transmission

Elektronsko izdajanje računov - 4. del: Smernice o interoperabilnosti elektronskih računov na prenosni ravni

To tehnično poročilo podaja smernice o interoperabilnosti elektronskih računov na prenosni ravni ob upoštevanju potrebe po zagotavljanju pristnosti izvora in celovitosti elektronskih računov.

General Information

- Status

- Published

- Publication Date

- 04-Jul-2017

- Technical Committee

- CEN/TC 434 - Project Committee - Electronic Invoicing

- Drafting Committee

- CEN/TC 434/WG 6 - Guidelines at transmission level

- Current Stage

- 6060 - Definitive text made available (DAV) - Publishing

- Start Date

- 05-Jul-2017

- Due Date

- 18-May-2018

- Completion Date

- 05-Jul-2017

Overview

CEN/TR 16931-4:2017 - "Electronic invoicing - Part 4: Guidelines on interoperability of electronic invoices at the transmission level" - is a non‑binding Technical Report from CEN that provides recommendations to ensure interoperable transmission of e‑invoices across the EU/EEA and Switzerland. Designed to be used alongside EN 16931 (the core invoice semantic data model) and related technical parts, the Guidelines focus on transmission‑level best practices that support reliable exchange, authenticity, integrity, routing and format handling while remaining technology‑neutral.

Key topics and requirements

The report addresses transmission‑level interoperability through a set of practical topics and guiding principles:

- Common terminology and use of non‑proprietary standards to reduce ambiguity across networks and providers.

- Best practices for transmission and network services, supporting Internet, VPN and managed service deployments.

- Identification, addressing and routing rules to enable delivery between any sender and any receiver across European markets.

- Authenticity of origin and integrity of invoice content to ensure trust in transmitted e‑invoices.

- Data protection guidance covering privacy and handling of personal or business data.

- Format conversion and legibility: considerations for enabling conversion between syntaxes and for producing human‑readable visual presentations (including hybrid invoices).

- Support for multiple operating models (direct/bilateral, three‑corner, four‑corner) with tailored recommendations per model.

- Legal and governance requirements, including the need for robust contractual and governance arrangements at the transmission level.

- Principles to enable competition and network effects, while leaving competitive details (pricing, business integration, proprietary service features) out of scope.

The Guidelines aim to support EU Directive 2014/55/EU implementation and facilitate Straight Through Processing (STP) across buyers, sellers, tax authorities, banks and service providers.

Applications and users

CEN/TR 16931-4:2017 is useful for:

- Public administrations implementing mandatory e‑invoice reception under Directive 2014/55/EU.

- Software vendors and service providers (e‑invoicing platforms, gateways, format converters) designing transmission solutions.

- Enterprises and accounting teams planning cross‑border e‑invoicing and STP.

- National bodies and sector associations developing national practical guidance and rollout strategies.

- Tax authorities and banks integrating e‑invoicing into fiscal and payment processes.

Because the Guidelines are non‑prescriptive, they provide a neutral baseline to increase reachability and interoperability without prescribing specific commercial models.

Related standards

- EN 16931‑1:2017 - Semantic data model of the core elements of an electronic invoice

- CEN/TS 16931‑2 - List of syntaxes compliant with EN 16931‑1

- CEN/TS 16931‑3‑x - Syntax binding parts

- CEN/TR 16931‑5, FprCEN/TR 16931‑6 - Guidance on extensions and practical testing

Keywords: CEN/TR 16931-4:2017, electronic invoicing, e‑invoicing, interoperability, transmission level, EN 16931, EU Directive 2014/55/EU, STP, format conversion, data protection.

Get Certified

Connect with accredited certification bodies for this standard

BSI Group

BSI (British Standards Institution) is the business standards company that helps organizations make excellence a habit.

NYCE

Mexican standards and certification body.

Sponsored listings

Frequently Asked Questions

CEN/TR 16931-4:2017 is a technical report published by the European Committee for Standardization (CEN). Its full title is "Electronic invoicing - Part 4: Guidelines on interoperability of electronic invoices at the transmission level". This standard covers: This Technical Report recommends a set of Guidelines to ensure interoperability at the transmission level to be used in conjunction with the European Norm (EN) for the semantic data model of the core elements of an electronic invoice and its other associated deliverables. The Guidelines are by nature non-prescriptive and non-binding. These Guidelines take into account the following aspects: 1) recommending best practices for use at the transmission level; 2) supporting interoperability between all the parties and systems that need to interact and within the various operating models in common use; 3) ensuring a level playing field for the various operating models and bi-lateral implementations and for the use of existing and future infrastructures, which support e-Invoicing; 4) promoting a common terminology and non-proprietary standards for transmission and related areas; 5) ensuring the authenticity of origin and integrity of electronic invoice content; 6) providing guidance on data protection, on the enablement of format conversion, and on e-invoice legibility, including the use of a readable visual presentations, as required; 7) providing guidance for identification, addressing and routing; 8) identifying requirements for robust legal frameworks and governance arrangements; 9) recognizing the roles of trading parties, solution and service providers and related infrastructure providers. The Objectives of the Guidelines are: 10) to support the implementation of the EU Directive 2014/55/EU on e-Invoicing and the core invoice model; 11) to propose best practices and recommendations for standards to enable electronic exchange of e-Invoices and related data between participants by providing a basis for interoperability at the transmission level, based on common requirements and scenarios; 12) to facilitate Straight Through Processing (STP) by the key actors in the supply chain (Buyers, Sellers, Tax Authorities, Agents, Banks, Service and Solution Providers, etc.); 13) to provide a set of non-prescriptive and non-binding Guidelines and recommendations that are applicable to all common operating models for e-invoice exchange and transmission whilst also providing recommendations specific to each of the common operating models. To accomplish these objectives, the Guidelines are based on the following Requirements and Guiding Principles: 14) the need to cover the transmission of e-invoices and related documents from the system of the sending trading party to the system of the receiving trading party, including transmission issues for any intermediary platforms; 15) the need to allow any seller in any European (EU, EEA and Switzerland) country to deliver invoices to any buyer in any location in another European country (EU, EEA and Switzerland); 16) the need to support all common invoicing processes and modes of operation; 17) the need to be compatible with the current legislative and regulatory environment for the exchange of e-Invoices and related data; 18) the need to support the European Norm and other commonly accepted content standards; 19) the need to ensure that other document exchanges beyond e-Invoicing can be supported; 20) the need to establish clear boundaries between the collaborative and competitive domains; 21) the need to enable competition between business models, solutions and service providers and foster innovation; 22) the need to ensure that European supply chains remain an integrated and competitive part of the global economy; 23) the need to promote network effects leading to the development of critical mass as e-Invoicing becomes the dominant mode of invoicing (network effects result in a service becoming more valuable as more trading parties use it, thus creating a virtuous circle and further momentum for adoption). The following items are considered to be in the competitive domain and therefore out of scope of the Recommendations: (....)

This Technical Report recommends a set of Guidelines to ensure interoperability at the transmission level to be used in conjunction with the European Norm (EN) for the semantic data model of the core elements of an electronic invoice and its other associated deliverables. The Guidelines are by nature non-prescriptive and non-binding. These Guidelines take into account the following aspects: 1) recommending best practices for use at the transmission level; 2) supporting interoperability between all the parties and systems that need to interact and within the various operating models in common use; 3) ensuring a level playing field for the various operating models and bi-lateral implementations and for the use of existing and future infrastructures, which support e-Invoicing; 4) promoting a common terminology and non-proprietary standards for transmission and related areas; 5) ensuring the authenticity of origin and integrity of electronic invoice content; 6) providing guidance on data protection, on the enablement of format conversion, and on e-invoice legibility, including the use of a readable visual presentations, as required; 7) providing guidance for identification, addressing and routing; 8) identifying requirements for robust legal frameworks and governance arrangements; 9) recognizing the roles of trading parties, solution and service providers and related infrastructure providers. The Objectives of the Guidelines are: 10) to support the implementation of the EU Directive 2014/55/EU on e-Invoicing and the core invoice model; 11) to propose best practices and recommendations for standards to enable electronic exchange of e-Invoices and related data between participants by providing a basis for interoperability at the transmission level, based on common requirements and scenarios; 12) to facilitate Straight Through Processing (STP) by the key actors in the supply chain (Buyers, Sellers, Tax Authorities, Agents, Banks, Service and Solution Providers, etc.); 13) to provide a set of non-prescriptive and non-binding Guidelines and recommendations that are applicable to all common operating models for e-invoice exchange and transmission whilst also providing recommendations specific to each of the common operating models. To accomplish these objectives, the Guidelines are based on the following Requirements and Guiding Principles: 14) the need to cover the transmission of e-invoices and related documents from the system of the sending trading party to the system of the receiving trading party, including transmission issues for any intermediary platforms; 15) the need to allow any seller in any European (EU, EEA and Switzerland) country to deliver invoices to any buyer in any location in another European country (EU, EEA and Switzerland); 16) the need to support all common invoicing processes and modes of operation; 17) the need to be compatible with the current legislative and regulatory environment for the exchange of e-Invoices and related data; 18) the need to support the European Norm and other commonly accepted content standards; 19) the need to ensure that other document exchanges beyond e-Invoicing can be supported; 20) the need to establish clear boundaries between the collaborative and competitive domains; 21) the need to enable competition between business models, solutions and service providers and foster innovation; 22) the need to ensure that European supply chains remain an integrated and competitive part of the global economy; 23) the need to promote network effects leading to the development of critical mass as e-Invoicing becomes the dominant mode of invoicing (network effects result in a service becoming more valuable as more trading parties use it, thus creating a virtuous circle and further momentum for adoption). The following items are considered to be in the competitive domain and therefore out of scope of the Recommendations: (....)

CEN/TR 16931-4:2017 is classified under the following ICS (International Classification for Standards) categories: 35.240.20 - IT applications in office work; 35.240.63 - IT applications in trade. The ICS classification helps identify the subject area and facilitates finding related standards.

CEN/TR 16931-4:2017 is associated with the following European legislation: EU Directives/Regulations: 2014/55/EU; Standardization Mandates: M/528. When a standard is cited in the Official Journal of the European Union, products manufactured in conformity with it benefit from a presumption of conformity with the essential requirements of the corresponding EU directive or regulation.

CEN/TR 16931-4:2017 is available in PDF format for immediate download after purchase. The document can be added to your cart and obtained through the secure checkout process. Digital delivery ensures instant access to the complete standard document.

Standards Content (Sample)

SLOVENSKI STANDARD

01-oktober-2017

Elektronsko izdajanje računov - 4. del: Smernice o interoperabilnosti elektronskih

računov na prenosni ravni

Electronic invoicing - Part 4: Guidelines on interoperability of electronic invoices at the

transmission level

Elektronische Rechnungsstellung - Teil 4: Leitfaden über die Interoperabilität

elektronischer Rechnungen auf der Übertragungsebene

Facturation électronique - Partie 4: Lignes directrices relatives à l’interopérabilité des

factures électroniques au niveau de la transmission

Ta slovenski standard je istoveten z: CEN/TR 16931-4:2017

ICS:

03.100.20 Trgovina. Komercialna Trade. Commercial function.

dejavnost. Trženje Marketing

35.240.63 Uporabniške rešitve IT v IT applications in trade

trgovini

2003-01.Slovenski inštitut za standardizacijo. Razmnoževanje celote ali delov tega standarda ni dovoljeno.

CEN/TR 16931-4

TECHNICAL REPORT

RAPPORT TECHNIQUE

July 2017

TECHNISCHER BERICHT

ICS 35.240.63; 35.240.20

English Version

Electronic invoicing - Part 4: Guidelines on interoperability

of electronic invoices at the transmission level

Facturation électronique - Partie 4: Lignes directrices Elektronische Rechnungsstellung - Teil 4: Leitfaden

relatives à l'interopérabilité des factures électroniques über die Interoperabilität elektronischer Rechnungen

au niveau de la transmission auf der Übertragungsebene

This Technical Report was approved by CEN on 14 May 2017. It has been drawn up by the Technical Committee CEN/TC 434.

CEN members are the national standards bodies of Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia,

Finland, Former Yugoslav Republic of Macedonia, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania,

Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland,

Turkey and United Kingdom.

EUROPEAN COMMITTEE FOR STANDARDIZATION

COMITÉ EUROPÉEN DE NORMALISATION

EUROPÄISCHES KOMITEE FÜR NORMUNG

CEN-CENELEC Management Centre: Avenue Marnix 17, B-1000 Brussels

© 2017 CEN All rights of exploitation in any form and by any means reserved Ref. No. CEN/TR 16931-4:2017 E

worldwide for CEN national Members.

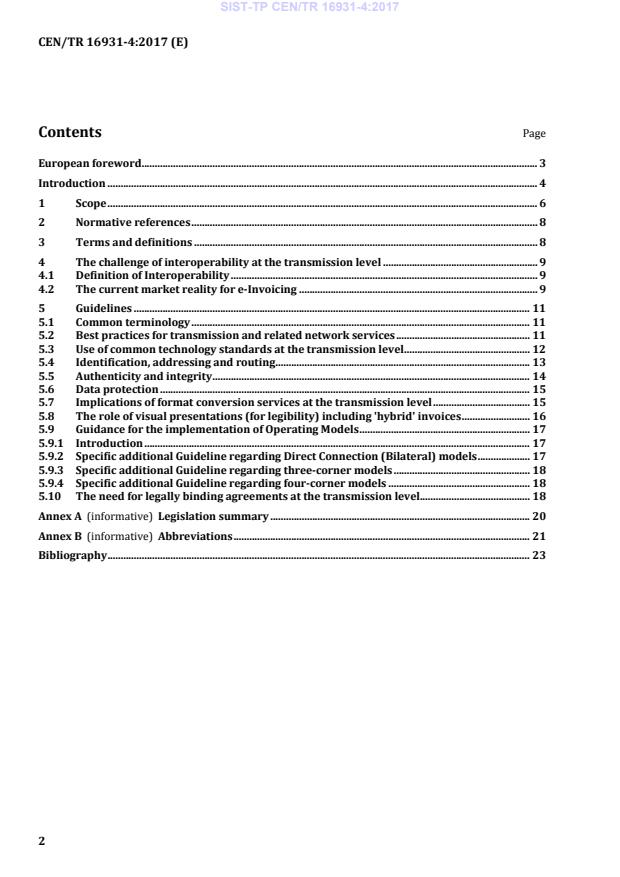

Contents Page

European foreword . 3

Introduction . 4

1 Scope . 6

2 Normative references . 8

3 Terms and definitions . 8

4 The challenge of interoperability at the transmission level . 9

4.1 Definition of Interoperability . 9

4.2 The current market reality for e-Invoicing . 9

5 Guidelines . 11

5.1 Common terminology . 11

5.2 Best practices for transmission and related network services . 11

5.3 Use of common technology standards at the transmission level . 12

5.4 Identification, addressing and routing . 13

5.5 Authenticity and integrity . 14

5.6 Data protection . 15

5.7 Implications of format conversion services at the transmission level . 15

5.8 The role of visual presentations (for legibility) including 'hybrid' invoices . 16

5.9 Guidance for the implementation of Operating Models . 17

5.9.1 Introduction . 17

5.9.2 Specific additional Guideline regarding Direct Connection (Bilateral) models . 17

5.9.3 Specific additional Guideline regarding three-corner models . 18

5.9.4 Specific additional Guideline regarding four-corner models . 18

5.10 The need for legally binding agreements at the transmission level . 18

Annex A (informative) Legislation summary . 20

Annex B (informative) Abbreviations . 21

Bibliography . 23

European foreword

This document (CEN/TR 16931-4:2017) has been prepared by Technical Committee CEN/TC 434

“Electronic invoicing”, the secretariat of which is held by NEN.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. CEN shall not be held responsible for identifying any or all such patent rights.

This document has been prepared under a mandate given to CEN by the European Commission and the

European Free Trade Association.

This document is part of a set of documents, consisting of:

— EN 16931-1:2017, Electronic invoicing — Part 1: Semantic data model of the core elements of an

electronic invoice;

— CEN/TS 16931-2:2017, Electronic invoicing — Part 2: List of syntaxes that comply with EN 16931-1;

— CEN/TS 16931-3-1:2017, Electronic invoicing — Part 3-1: Methodology for syntax bindings of the

core elements of an electronic invoice;

— CEN/TS 16931-3-2:2017, Electronic invoicing — Part 3-2: Syntax binding for ISO/IEC 19845 (UBL

2.1) invoice and credit note;

— CEN/TS 16931-3-3:2017, Electronic invoicing — Part 3-3: Syntax binding for UN/CEFACT XML

Industry Invoice D16B;

— CEN/TS 16931-3-4:2017, Electronic invoicing — Part 3-4: Syntax binding for UN/EDIFACT INVOIC

D16B;

— CEN/TR 16931-4:2017, Electronic invoicing — Part 4: Guidelines on interoperability of electronic

invoices at the transmission level;

— CEN/TR 16931-5:2017, Electronic invoicing — Part 5: Guidelines on the use of sector or country

extensions in conjunction with EN 16931-1, methodology to be applied in the real environment;

— FprCEN/TR 16931-6:2017, Electronic invoicing — Part 6: Result of the test of EN 16931-1 with

respect to its practical application for an end user.

Introduction

The European Commission states that “The mass adoption of e-invoicing within the EU would lead to

significant economic benefits and it is estimated that moving from paper to e-invoices will generate

savings of around EUR 240 billion over a six-year period” [1]. Based on this recognition “The

Commission wants to see e-invoicing become the predominant method of invoicing by 2020 in Europe”.

As a means to achieve this goal, Directive 2014/55/EU [2] on electronic invoicing in public

procurement aims at facilitating the use of electronic invoices by economic operators when supplying

goods, works and services to public administrations (B2G), as well as the support for trading between

economic operators themselves (B2B). In particular, it sets out the legal framework for the

establishment and adoption of a European Standard (EN) for the semantic data model of the core

elements of an electronic invoice (EN 16931-1).

In line with Directive 2014/55/EU [2], and after publication of the reference to EN 16931-1 in the

Official Journal of the European Union, all contracting public authorities and contracting entities in the

EU will be obliged to receive and process an e-invoice as long as:

— it is in conformance with the semantic content as described in EN 16931-1;

— it is represented in any of the syntaxes identified in CEN/TS 16931-2, in accordance with the

request referred to in Paragraph 1 of Article 3 of Directive 2014/55/EU;

— it is in conformance with the appropriate mapping defined in the applicable subpart of

CEN/TS 16931-3 (all parts).

The Standardization Request issued by the European Commission in connection with

Directive 2014/55/EU requested that CEN should also develop Guidelines on interoperability of

electronic invoices at the transmission level, taking into account the need of ensuring the authenticity of

the origin and the integrity of the electronic invoices’ content, to be given in a Technical Report (TR)

The Guidelines cover interoperability at the transmission level for invoices based on the core invoice

model and its syntax representations to and from the involved trading and supporting parties. They

could also be applied more widely to cover the transmission of electronic invoices rendered in other

standards and formats i.e. they are invoice content and format neutral.

The Guidelines for interoperability at the transmission level (the Guidelines) are intended to guide all

stakeholders who make use of e-Invoicing within the European Union (EU) and the European Economic

Area (EEA), and Switzerland. They are addressed to trading parties, service and software providers in

relation to the transmission methods or network solutions they use or support, in order to encourage

the adoption and further development of good practices, recommendations and standards for the

transmission level. This is intended to promote efficient, cost effective and widely available e-Invoicing

practices and services.

It is expected that some groups of stakeholders, such as small and medium-sized businesses (SMEs) and

smaller contracting authorities, may find these Guidelines inherently technically challenging and

inaccessible at a practical level. This is recognized, and consequently it is important that at a context-

specific level e.g. at Member State or Sector level, policy-makers, larger contracting authorities, SME

representative and municipal associations, supportive government agencies, professional advisers, and

service and solution providers take responsibility to guide such organizations in relation to these

Guidelines. It is by the nature of the Guidelines that the provision of further specific guidance for SMEs

and smaller contracting authorities could not be done at a European level, but rather at national and

sector-specific level,

It is recommended that the Guidelines set out herein are adopted by market participants, in such a way

that separate and competing approaches, solutions and networks find common ground at the

transmission level, and on the basis of which trading parties are able to reach the maximum number of

their counterparties in a convenient manner. The Guidelines leave as many aspects as possible as a

matter of choice or in the competitive domain by only focusing on those features of transmission that

are essential to establishing interoperability.

It is envisaged that a large number of network and network-based solution instances will subscribe to

and adopt the Guidelines. There is a clear separation between the Guidelines and the design and

implementation of individual network and transmission solutions, which range from use of the ‘open’

Internet through virtual private Networks and managed services. The Guidelines are neutral as to the

individual interoperability models that the market develops and uses to accelerate the mass adoption of

e-Invoicing.

The following EU stakeholders have been consulted in addition to the Members of CEN/TC 434 and

their supporting National Standards Organizations (NSOs):

— European Multi Stakeholder Forum on e-Invoicing;

— European Commission units responsible for EU Large Scale Pilots, in particular e-SENS – DIGIT, DG

CONNECT, DG GROW, and for the Connecting Europe Facility (CEF) in particular the Digital Service

Infrastructure for e- Delivery;

— OpenPEPPOL Association;

— European E-invoicing Service Providers Association (EESPA).

1 Scope

This Technical Report recommends a set of Guidelines to ensure interoperability at the transmission

level to be used in conjunction with the European Norm (EN) for the semantic data model of the core

elements of an electronic invoice and its other associated deliverables. The Guidelines are by nature

non-prescriptive and non-binding.

These Guidelines take into account the following aspects:

1) recommending best practices for use at the transmission level;

2) supporting interoperability between all the parties and systems that need to interact and within the

various operating models in common use;

3) ensuring a level playing field for the various operating models and bi-lateral implementations and

for the use of existing and future infrastructures, which support e-Invoicing;

4) promoting a common terminology and non-proprietary standards for transmission and related

areas;

5) ensuring the authenticity of origin and integrity of electronic invoice content;

6) providing guidance on data protection, on the enablement of format conversion, and on e-invoice

legibility, including the use of a readable visual presentations, as required;

7) providing guidance for identification, addressing and routing;

8) identifying requirements for robust legal frameworks and governance arrangements;

9) recognizing the roles of trading parties, solution and service providers and related infrastructure

providers.

The Objectives of the Guidelines are:

10) to support the implementation of the EU Directive 2014/55/EU on e-Invoicing and the core invoice

model;

11) to propose best practices and recommendations for standards to enable electronic exchange of e-

Invoices and related data between participants by providing a basis for interoperability at the

transmission level, based on common requirements and scenarios;

12) to facilitate Straight Through Processing (STP) by the key actors in the supply chain (Buyers,

Sellers, Tax Authorities, Agents, Banks, Service and Solution Providers, etc.);

13) to provide a set of non-prescriptive and non-binding Guidelines and recommendations that are

applicable to all common operating models for e-invoice exchange and transmission whilst also

providing recommendations specific to each of the common operating models.

To accomplish these objectives, the Guidelines are based on the following Requirements and Guiding

Principles:

14) the need to cover the transmission of e-invoices and related documents from the system of the

sending trading party to the system of the receiving trading party, including transmission issues for

any intermediary platforms;

15) the need to allow any seller in any European (EU, EEA and Switzerland) country to deliver invoices

to any buyer in any location in another European country (EU, EEA and Switzerland);

16) the need to support all common invoicing processes and modes of operation;

17) the need to be compatible with the current legislative and regulatory environment for the exchange

of e-Invoices and related data;

18) the need to support the European Norm and other commonly accepted content standards;

19) the need to ensure that other document exchanges beyond e-Invoicing can be supported;

20) the need to establish clear boundaries between the collaborative and competitive domains;

21) the need to enable competition between business models, solutions and service providers and

foster innovation;

22) the need to ensure that European supply chains remain an integrated and competitive part of the

global economy;

23) the need to promote network effects leading to the development of critical mass as e-Invoicing

becomes the dominant mode of invoicing (network effects result in a service becoming more

valuable as more trading parties use it, thus creating a virtuous circle and further momentum for

adoption).

The following items are considered to be in the competitive domain and therefore out of scope of the

Recommendations:

24) Private entity space: the private entity space meaning the internal functionality or behaviour of any

individual sender and receiver of invoices and their solution and service providers.

25) Schemes and community solutions: as described above, the creation of these Guidelines for

interoperability at the transmission level is considered to be a collaborative activity. Individual

schemes, operating models, networks and network-based solutions at a European, national, global,

or sector level are considered as lying in the competitive domain for the purposes of these

Guidelines.

26) Choice of networks and technical solutions: the usage of any particular network or technical

solution by any community or bilateral pair of service providers is a private competitive matter.

27) Service offerings: the actual utilization of the Guidelines in relation to a commercial service offering

is a commercial activity and therefore out of scope.

28) Business integration: the integration of services with other processes, systems or solutions is in the

competitive domain, as is storage and archiving.

29) Pricing: pricing and contractual arrangements in any form are in the competitive domain.

30) Legal and tax compliance: steps taken to ensure compliance with legal and tax requirements are

private obligations of taxable persons.

2 Normative references

Not applicable.

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

3.1

transmission

delivery (including sending and receiving), presentation or the ‘making available’ of invoices in a timely

and secure manner between trading parties and any third parties acting on their behalf

3.2

bilateral model

model in which the transmission takes place on a direct connection basis between the trading parties

3.3

three-corner model

model in which a single service provider acts on behalf of both the supplier and the buyer to offer e-

Invoicing and other supply chain services

3.4

four-corner model

model in which the seller and buyer each have their own service provider, which in turn inter-operate

with each other, either on the basis of bilateral agreements, or as part of a multilateral network

3.5

interoperability

ability of disparate and diverse organizations to interact towards mutually beneficial and agreed

common goals, involving the sharing of information and knowledge between the organizations, through

the business processes they support, and by means of the exchange of data between their respective ICT

systems

3.6

network and network-based solution

physical or virtual electronic network based on a specification and a contractual framework, in which

multiple parties engage in electronic transmission

3.7

service or solution provider

intermediary party, which provides facilities or tools for the transmission of e-invoices and other

documents and messages

3.8

trading party

party which may either be the invoice sender or receiver being the parties engaged in the supply and

receipt of goods and services

3.9

structured format for an electronic invoice

invoice that has been issued, transmitted and received in a structured code electronic format, often

based on mark-up, which allows for its automatic and electronic processing

3.10

unstructured format for an electronic invoice

invoice that has been issued as a document containing information that is purely alpha-numeric in

nature or represents an image, capable of being read by a human, but not automatically processed

4 The challenge of interoperability at the transmission level

4.1 Definition of Interoperability

The European Interoperability Framework (EIF) defines interoperability as “…the ability of disparate

and diverse organizations to interact towards mutually beneficial and agreed common goals, involving

the sharing of information and knowledge between the organizations, through the business processes

they support, and by means of the exchange of data between their respective Information, Computer

and Technology (ICT) systems” [3].”

The goal of interoperability is to allow information to be presented in a consistent manner between

business systems, regardless of technology, application or platform. It thus provides organizations with

the ability to transfer and use information across multiple technologies and systems by creating

commonality in the way that business systems share information and processes across organizational

boundaries. Such processes should not involve the end-user in onerous initiation and operational

processes.

In a heterogeneous business environment actors do not need to know in detail how another actor

operates within its internal environment; however, the existence of business agreements that set out a

common collaborative way of working together is vital.

Interoperability can be identified on four different levels:

1) legal interoperability;

2) business and organizational interoperability;

3) process interoperability- semantic;

4) technical interoperability- syntax and transmission (the latter being the subject of these

Guidelines).

At the transmission level, there is a focus on the methods and practices through which delivery,

presentation or the ‘making available’ of invoices are conducted in a timely and secure manner. This

includes related requirements such as validation, signing, encryption, the enablement of format

conversion but not issues concerning invoice content or message payload. The focus is on the delivery

or presentation of e-invoices and related documents from the system of the sending trading party to the

system of the receiving trading party, including transmission issues for any intermediary platforms.

4.2 The current market reality for e-Invoicing

As essential context for developing relevant Guidelines for the transmission level it is important to

understand the current market reality for e-Invoicing across Europe.

Trade involves many types of trading party (e.g. businesses of all sizes, consumers and government

agencies) trading with each other. A lack of interoperability between the many trading parties and the

operating models they use for the electronic transmission of trade information could, if not addressed,

inhibit participation by important market segments such as small businesses and smaller contracting

authorities; it will also create barriers to reach, which is the ability of one entity to forward electronic

business documents to another in a safe and predictable manner.

By addressing cooperation to create interoperability at all levels including transmission, all trading

parties (suppliers and buyers) and service providers should be better able to work with their counter-

parties. The European economy will benefit in terms of cost effectiveness from the results of

standardization, while at the same time continuing to benefit from a vigorous competitive market for e-

Invoicing solutions.

The following is the current market reality in the general landscape for e- Invoicing services and

provides context for the creation of the Guidelines:

Relative immaturity: whilst e-Invoicing technologies have been maturing for some time, the trend

towards e-Invoicing adoption and the development of supporting services is still relatively young and

most actors are in a build-up phase. The market for supporting services has developed to help trading

parties overcome business and technical complexity and any perceived uncertainty in the legal

environment. Geographic regions and countries are at varying stages of maturity in terms of e-Invoicing

adoption. Many heterogeneous and incompatible e-Invoicing processes and transmission methods have

evolved and have been adopted in the market. The trust equation for electronic business between users

and between service providers and users is still emerging and business models are still developing.

Fragmentation: The use of multiple standards for invoice content and multiple transmission methods

creates complexity and may be impeding the achievement of critical mass. Format conversion services

provided by service providers shield users from these underlying problems. Many trading parties

engage in bilateral connections using humanly generated unstructured formats, such as PDFs, but the

usage of unstructured formats leads to suboptimal processes due to the resultant absence of end-to-end

business process automation. Structured formats make possible significant benefits from automated

processing, but where such formats are in use, they often use sector-specific or local formats and

transmission channels.

The needs of smaller businesses: Small business is not fully engaged with e-invoicing at this stage.

Many are required to participate in e-Invoicing based on the automation of supply chains by larger

enterprises or invoice other SMEs and individuals using PDFs. Efforts are needed to provide easy to use

tools, transmission methods and other capabilities to enable full participation by SMEs, preferably

without involving software installation and maintenance.

Operating models: Direct (bilateral) connections are common. However, many invoice exchanges are

intermediated using 'Three-Corner' models, often cloud-based, in which buyers and sellers participate

in various communities by being connected to a number of separate service platforms. This is common

in the automated supply chain segment especially but not exclusively B2B. 'Four-Corner' models

involving connections between service providers are being increasingly deployed.

At the current stage in the development of e-Invoicing, the following are therefore the principal

examples of operating models:

— bilateral, peer-to-peer, hub and spoke, and Electronic Data Interchange (EDI) models, whereby

transmission takes place via a direct or point to point connection between the trading parties;

— three-corner model whereby a single service provider or network acts on behalf of both the

supplier and the buyer to offer e-Invoicing and other supply chain services;

— four-corner model whereby the seller and buyer each have their own service provider, which in

turn inter-operate with each other either on the basis of bilateral agreements or as part of a

multilateral network.

Figure 1 — Common operating models for e-Invoicing

5 Guidelines

5.1 Common terminology

This Guideline calls for the consistent use of terminology to describe and clarify the roles and

responsibilities of actors and roles involved in transmission. Much of the required terminology is

embedded in the EN, but there are other terms relevant to the transmission level, a selection of which

are set out in this document. As terms and definitions are used by actors in the transmission process,

they should be clearly defined and consistently used in legal and operational documents. Reference

should be made to common definitions used by standardization bodies, such as CEN, UN/CEFACT and

ISO.

5.2 Best practices for transmission and related network services

The following business and technical best practices to ensure interoperable transmission are proposed,

whilst recognizing that their actual adoption or their provision by means of services is a matter of

choice and lie in the competitive domain:

1) Agreement on transmission method: Trading parties should agree on, or find acceptable, one or

more transmission channels to be used for e-Invoicing and related communication. Such channels

will usually, be established at the initiative of the invoice receiver, and this could be termed a 'pull'

mode. In other cases, the invoice sender may create or find an electronic connection acceptable to

the invoice receiver, and this could be termed a 'push' mode.

2) Needs of trading parties: In establishing such transmission channels the initiator of the

transmission method should take into account the needs of their trading party, in terms of ease of

use and factors such as size of enterprise, technical capability and geographic location, providing,

where appropriate, choice and flexibility. There is a need for easy to use and cost effective solutions

for SMEs to send invoices to their buyers whilst not impeding process automation on the buyer

side.

3) Transmission availability: All networks and transmission methods should support reliability,

availability and resilience as appropriate to the business circumstances. There should be support

for multiple time-zones and, as feasible, 24x7x365 service availability.

4) Message structure and identifiers: There should be a separation of the message header,

envelope, or metadata from message content or payload. Message identifiers should be available so

that individual messages are unambiguously identifiable. Where a networks are provided for e-

invoice delivery, an identifier for each network instance should be made available in order to

unambiguously identify each network and permit interoperability between networks.

5) Message types: There should be made available or mutually agreed a comprehensive range of

message types, including business level responses and message level responses, such as

acknowledgements, invoice status, response messages and rejections.

6) Clear boundaries: There should be clear definitions as to where a transmission process begins and

ends and what gateway, node or access point creates the boundary between the system of the

sender or receiver. Such boundary conditions shall be consistent with the allocation of business and

legal responsibility and liability.

7) Transmission security: All transmission connections including access to portals and websites

should be protected by security and confidentiality methods and devices, such as firewalls, access

controls and the use of electronic signatures (advanced and qualified digital signatures). Security

requirements need to include protection of the transmission process from intrusion and

infringement of confidentiality. Encryption may be employed where appropriate in the context of

the data being exchanged.

8) Web services: The employment of websites for uploading and downloading e-invoices, data and

related documents should be deployed in an easy-to-use and secure manner. It is possible to

organize secure transmission within a secure 'closed loop' environment based on such web

services.

9) E-mail: The use of e-mail is very widespread and allows messages to reach the intended recipients

in the vast majority of instances, although delivery is not guaranteed. Nevertheless additional

controls should be considered by sender and receiver to mitigate basic e-mail limitations, such as

the impact of spam, fraud attacks and lack of confidentiality. Additional controls such as encryption,

the use of digital signatures, response messages and delivery confirmations, should be agreed and

documented. Senders and receivers also need to have a clear definition of the e-mail process to be

used (payload attached or embedded in the body of the message, the use of compression, the

number of documents per email, etc.). Due to the nature of the email protocol, the receiver will

need to pay special attention to issues of authentication and security, and the methods issues

described in 6.2. E-delivery Services as defined in the eIDAS regulation are recommended in

appropriate circumstances. These provide an enhanced form of e-mail with supporting evidence

relating to the handling of an e-mail including proof of submission and delivery.

Further requirements for technology standards, addressing and routing, authenticity and integrity, and

data protection are covered in the paragraphs below.

5.3 Use of common technology standards at the transmission level

This Guideline recommends the use of common, non-proprietary, royalty-free European and

international information technology standards for communication and related areas such as security.

Such standards and technology should enable interoperability and foster competition and innovation.

The number of strictly mandated technical requirements shall be kept to a minimum as a matter of

principle.

Examples of standards relevant to these Guidelines at the transmission level are:

1) AS2 (IETF), AS4 (OASIS), OFTP2 (ODETTE) and SMTP (Email) - protocols for the secure and reliable

transmission of messages across the Internet;

2) SBDH - a standard for the envelope or header, which incorporates a payload or content message

such as an e-invoice;

3) SML/SMP (Service Metadata Locator/Service Metadata Publisher) – Oasis Specifications for

distributed registry lookup and discovery;

4) digital certificates/PKI (Public key Infrastructure) – ETSI standards for trust services;

5) http protocol based standards and specifications (REST, Web services, SSL/TLS etc.) for web

applications.

Attention is drawn to the CEF e-Delivery which has the status of a generic Digital Service Infrastructure

in the CEF programme in the area of data exchange with a focus on interoperability, security, scalability

and performance, and legal assurance and accountability. CEF e-Delivery is developed by the European

Commission in consultation with other stakeholders based on the e-SENS Large Scale Pilots and the

PEPPOL specifications. These may be used to support any four-corner model for the exchange of e-

invoices or other related documents and are accordingly recommended for adoption, as appropriate.

CEF is the Connecting Europe Facility a multi-year funding and policy programme involving transport,

energy and telecoms, supporting the EU Digital Single Strategy initiative.

The e-Delivery building blocks can be found on https://joinup.ec.europa.eu/community/cef/.

ETSI/TS 102 640 about Registered Electronic Mail (REM) and ETSI SR 019 050 about Electronic

Registered Delivery Services (ERDS) are relevant standards for the implementation and

interconnection of invoice transmission services. ETSI/TS 102 640-5 about REM-MD Interoperability

Profiles provides relevant standards for the interconnection of both types of transmission services:

i.e. Store and Forward (S&F) and Store and Notify (S&N). ETSI is also preparing additional Standard

Reports and Technical Specifications as part of the M/460 mandate concerning the eIDAS trust services

– electronic registered mail and registered electronic delivery services. An important part of this work

programme are technical specifications “Testing Conformance and Interoperability” for delivery

services.

5.4 Identification, addressing and routing

This Guideline proposes the principles to be applied to the development of commonly recognized

identification schemes, interoperable addressing and routing processes both within and across different

domains and networks, and the identifiers that enable them. The proposed principles are as follows:

1) A distinction should be made between an identifier by which a person is generally recognized (e.g.

name, company number, VAT number etc.) and an address which is the location, at which a natural

person (individual) or legal person (corporate entity), a system, or a device may be reached,

recognizing that any of these may require more than one address.

2) All transmission solutions should provide or create the tools for the use of an unambiguous

identifier for both the users themselves and, where applicable for any associated solution or service

providers on a basis that is cost effective and easy to use including facilitating the transfer of

business relationships from one solution to another to avoid lock-in.

3) All solution and service providers should also obtain and widely distribute an address to enable

others to route all relevant messages to them and their customers.

4) Addresses and identifiers should be sufficient to support the processing of invoices, invoice related

messages and potentially other business messages to senders and receivers.

5) All networks and network based solutions should publicly make available their various addressing

and routing structures and numbering conventions on a transparent basis, as required by the needs

of their trading parties.

6) All networks and network based solutions are encouraged to (but should not be compelled to)

publish an easily accessible directory, in which are found the identifiers and addresses of end-

users, who wish that such information be published in this way.

7) Unless it is a condition of participating in a particular network or network based solution, no end-

user (a natural or legal person, being the ultimate invoice receiver or sender) should be compelled

to agree to the publication of such information, for any reason such as confidentiality, or the use of

practices where it discovers the necessary details on a private bilateral basis.

8) The identifiers should be capable of being re-used for other e-procurement services and preferably

be globally unique.

9) Existing identifiers and numbering conventions should be used where possible.

10) Attention is drawn to the SML/SMP/ Directory artefacts present in the PEPPOL and e-Delivery

specifications for the creation of Directory Services.

11) Commission Implementing Regulations (EU) 2015/1501 and 2015/1502 are additional regulations

concerning the identification of data relating to natural or legal persons, the applicable Levels of

Authentication (LOA) and the necessary controls.

Industry participants are encouraged to cooperate in the further development and adoption of more

interoperable and easy to use addressing and routing procedures within a standards body such as CEN

and ETSI and also, taking due account of relevant international standards.

5.5 Authenticity and integrity

The authenticity of the origin and the integrity of the content of any invoice should be ensured in

accordance with Article 233 of the VAT Directive 2010/45/EU, which describes three ways to ensure

authenticity of origin and integrity of invoice content:

Business controls which create a reliable audit trail. An example of a business control is the

matching of supporting documents such purchase orders, delivery notes and remittance advices.

Controls should be appropriate to the size, activity and type of the taxable person. An audit trail should

contain source documents, processed transactions and references to the linkage between them.

Business controls have no impact at the transmission level, so have no implication for these Guidelines

on transmission, as it is a pure business process handled before (by the sender) or after (by the

receiver) the actual transmission of the invoice; however, it is nevertheless recommended for quality

purposes to follow the best practices for transmission described in these Guidelines when using the

business controls method.

Advanced electronic signature. By definition, this type of signature uniquely identifies and links its

signatory to the content (authenticity of the origin) and invalidates the signature if the signed data has

been tampered with (integrity of the data). Advanced digital signatures can be technically implemented,

following the XAdES, PAdES or CadES (COMMISSION IMPLEMENTING DECISION (EU) 2015/1506). It is

recommended to always apply the signature to the transmitted payload so that the authenticity and

integrity of the invoice can be verified during the whole legal archiving period and for confidentiality

purposes. At the message or header level, the transmitted message could be also signed (e.g. when sent

using the AS2 protocol), for the whole or during a stage or stages of the transmission process, but the

use of signatures in these circumstances is separate from its use to ensure authenticity and integrity.

EDI (Electronic Data Interchange). There shall be a previously executed agreement between the

parties (Commission Recommendation 1994/820/EC) before any EDI transmission may be used as

guarantee for the authenticity of the origin and integrity of the data. The implemented transport

security methods should be documented in the agreement. There are various types of agreements

between parties that could be used for this purposes, such as bilateral agreements between two parties,

multilateral agreements used in legal frameworks such as OpenPEPPOL, and a variety of national

agreements.

The above three methods are cited in the Directive as valid options, but it is contemplated that there are

and will be in the future other possible ways of ensuring Authenticity and Integrity. An example is

described in the Regulation (EU) N°910/2014 on electronic identification and trust services for

electronic transactions in the Internal Market (eIDAS Regulation), which provides a regulatory

environment to enable secure and seamless electronic interactions between businesses, citizens and

public authorities. Among other items, it provides the regulatory environment for electronic signatures,

electronic seals, timestamps and other proofs for authentication mechanisms to enable electronic

transactions with the same legal standing as transactions performed on paper.

Mention should also be made of the e-Delivery services (Regulation (EU) N°910/2014) which defines a

service that makes it possible to transmit data between third parties by electronic means and provides

evidence relating to the handling of the transmitted data, including proof of sending and receiving the

data, and that protects transmitted data against the risk of loss, theft, damage or any unauthorized

alterations. Documents transmitted using an e-Delivery service are guaranteed to have authenticity,

integrity and confidentiality.

5.6 Data protection

Key principles for data protection when processing and transmitting invoices shall be applied:

— data shall be protected against unauthoriz

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.

Loading comments...