ISO 10962:2021

(Main)Securities and related financial instruments — Classification of financial instruments (CFI) code

Securities and related financial instruments — Classification of financial instruments (CFI) code

This document defines and describes the structure for the codes for an internationally valid system to classify financial instruments. The classification system applies to financial instruments negotiated internationally as well as to domestic instruments. The term “financial instruments” refers not only to classical securities and derivatives but also covers the innovative financial products that have emerged in different markets (a trend that is expected to continue in the future). This document is intended for use in any application in the trading and administration of financial instruments in the international securities business. Insofar as the trading and administration of securities do not affect other countries, the application of this document remains at the discretion of the responsible national bodies, such as stock exchanges, banks, brokers, regulatory bodies and other institutions active in the securities field. In principle, the CFI code reflects characteristics that are defined when a financial instrument is issued and that remain unchanged during its entire lifetime. However, a few events that can lead to a new CFI code for the same instrument are anticipated, such as the changing of voting rights or ownership restrictions by a stockholders' meeting.

Valeurs mobilières et autres instruments financiers concernés — Classification des instruments financiers (code CFI)

General Information

- Status

- Published

- Publication Date

- 17-May-2021

- Technical Committee

- ISO/TC 68/SC 8 - Reference data for financial services

- Drafting Committee

- ISO/TC 68/SC 8 - Reference data for financial services

- Current Stage

- 6060 - International Standard published

- Start Date

- 18-May-2021

- Due Date

- 15-Nov-2021

- Completion Date

- 18-May-2021

Relations

- Effective Date

- 12-Oct-2020

Overview

ISO 10962:2021 defines the Classification of Financial Instruments (CFI) code, an international standard for describing the nature and features of securities and related financial instruments. The standard specifies the code structure, semantic model, allocation and maintenance rules for a widely valid classification system that covers classical securities, derivatives and newer/innovative financial products. CFI codes are intended for use in trading, settlement, reference data and administration of instruments both in international markets and domestic contexts.

Key topics and technical requirements

- CFI code structure and semantics: formal definition of code elements that represent an instrument's category, group and attribute set; a semantic model for external code lists.

- Categories and code lists: predefined categories include Equities (E), Debt (D), Collective Investment Vehicles (C), Options (O), Futures (F), Swaps (S), Entitlements/Rights (R), Spot (I), Forwards (J) and more - each with specific group/attribute meanings.

- Code allocation rules: guidelines for assigning codes at issuance and handling existing instruments without a CFI.

- Persistence and change management: CFIs usually reflect characteristics fixed at issuance and remain unchanged; the standard anticipates limited events (e.g., changes in voting rights or ownership restrictions) that may require a new CFI.

- Maintenance: procedures for maintaining and updating code lists and definitions, including governance and versioning.

- Interoperability and implementation principles: conventions to ensure consistent interpretation across exchanges, data vendors and back-office systems.

Applications

- Standardizing instrument reference data in trading systems, order management systems and market data feeds.

- Enabling consistent regulatory reporting, reconciliation and compliance across jurisdictions.

- Supporting clearing and settlement, custodial record-keeping and corporate actions workflows.

- Improving data quality for risk management, analytics and portfolio systems by providing machine-readable instrument classifications.

- Facilitating interoperability between exchanges, brokers, data vendors and financial messaging systems.

Who uses this standard

- Stock exchanges, central securities depositories and clearing houses

- Banks, brokers, asset managers and custodians

- Regulators and supervisory authorities

- Data vendors, financial software vendors and enterprise reference-data teams

- Issuers and corporate registrars for correct instrument categorization at issuance

Related standards (context)

CFI codes are commonly used alongside instrument identifiers and messaging standards to provide complete reference data; practitioners typically integrate CFI with instrument identifiers, market identifiers and settlement/messaging schemas when building cross-border trading and reporting solutions.

Keywords: ISO 10962, CFI code, classification of financial instruments, securities classification, financial instrument taxonomy, trading reference data.

Buy Documents

ISO 10962:2021 - Securities and related financial instruments -- Classification of financial instruments (CFI) code

ISO 10962:2021REDLINE - Securities and related financial instruments -- Classification of financial instruments (CFI) code

ISO 10962:2021 - Securities and related financial instruments — Classification of financial instruments (CFI) code Released:5/18/2021

REDLINE ISO 10962:2021 - Securities and related financial instruments — Classification of financial instruments (CFI) code Released:5/18/2021

Get Certified

Connect with accredited certification bodies for this standard

Great Wall Tianjin Quality Assurance Center

Established 1993, first batch to receive national accreditation with IAF recognition.

Hong Kong Quality Assurance Agency (HKQAA)

Hong Kong's leading certification body.

Innovative Quality Certifications Pvt. Ltd. (IQCPL)

Known for integrity, providing ethical & impartial Assessment & Certification. CMMI Institute Partner.

Sponsored listings

Frequently Asked Questions

ISO 10962:2021 is a standard published by the International Organization for Standardization (ISO). Its full title is "Securities and related financial instruments — Classification of financial instruments (CFI) code". This standard covers: This document defines and describes the structure for the codes for an internationally valid system to classify financial instruments. The classification system applies to financial instruments negotiated internationally as well as to domestic instruments. The term “financial instruments” refers not only to classical securities and derivatives but also covers the innovative financial products that have emerged in different markets (a trend that is expected to continue in the future). This document is intended for use in any application in the trading and administration of financial instruments in the international securities business. Insofar as the trading and administration of securities do not affect other countries, the application of this document remains at the discretion of the responsible national bodies, such as stock exchanges, banks, brokers, regulatory bodies and other institutions active in the securities field. In principle, the CFI code reflects characteristics that are defined when a financial instrument is issued and that remain unchanged during its entire lifetime. However, a few events that can lead to a new CFI code for the same instrument are anticipated, such as the changing of voting rights or ownership restrictions by a stockholders' meeting.

This document defines and describes the structure for the codes for an internationally valid system to classify financial instruments. The classification system applies to financial instruments negotiated internationally as well as to domestic instruments. The term “financial instruments” refers not only to classical securities and derivatives but also covers the innovative financial products that have emerged in different markets (a trend that is expected to continue in the future). This document is intended for use in any application in the trading and administration of financial instruments in the international securities business. Insofar as the trading and administration of securities do not affect other countries, the application of this document remains at the discretion of the responsible national bodies, such as stock exchanges, banks, brokers, regulatory bodies and other institutions active in the securities field. In principle, the CFI code reflects characteristics that are defined when a financial instrument is issued and that remain unchanged during its entire lifetime. However, a few events that can lead to a new CFI code for the same instrument are anticipated, such as the changing of voting rights or ownership restrictions by a stockholders' meeting.

ISO 10962:2021 is classified under the following ICS (International Classification for Standards) categories: 03.060 - Finances. Banking. Monetary systems. Insurance. The ICS classification helps identify the subject area and facilitates finding related standards.

ISO 10962:2021 has the following relationships with other standards: It is inter standard links to ISO 10962:2019. Understanding these relationships helps ensure you are using the most current and applicable version of the standard.

ISO 10962:2021 is available in PDF format for immediate download after purchase. The document can be added to your cart and obtained through the secure checkout process. Digital delivery ensures instant access to the complete standard document.

Standards Content (Sample)

INTERNATIONAL ISO

STANDARD 10962

Fifth edition

2021-05

Securities and related financial

instruments — Classification of

financial instruments (CFI) code

Valeurs mobilières et autres instruments financiers concernés —

Classification des instruments financiers (code CFI)

Reference number

©

ISO 2021

© ISO 2021

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2021 – All rights reserved

Contents Page

Foreword .iv

Introduction .v

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Conventions and principles . 2

4.1 General . 2

4.2 Category . 4

4.3 Group . 4

4.4 Attributes . 4

4.5 Semantic model of the external code list for the CFI . 4

5 CFI code allocation . 6

5.1 General . 6

5.2 Existing CFI codes and existing financial instruments without a CFI code . 7

6 Maintenance . 7

Annex A (informative) Classification examples. 8

Bibliography . 9

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular, the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation of the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT), see www .iso .org/

iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 8,

Reference data for financial services.

This fifth edition cancels and replaces the fourth edition (ISO 10962:2019), which has been technically

revised. The six-character hierarchical structure remains unchanged from the previous version.

The main changes to the previous edition are as follows:

— The CFI code list has been removed from the specification and moved to an external code list.

— The structure of the CFI and content of the code list are captured in the form of a machine-readable

semantical model of the code lists and their values. It is important to understand that this is a

semantic representation of the CFI hierarchical structure and not a canonical semantic classification

of financial instruments, which is beyond the scope of this document.

— The CFI external code list is maintained and published by the ISO 10962 maintenance agency, which

is responsible for managing the modification and enhancement of the code lists, their values and

corresponding descriptions. The maintenance agency is responsible for publishing the CFI code list.

The CFI external code list is published in a selection of human-readable and machine-readable data

formats [e.g. spreadsheet, PDF, comma-separated values (CSV), JSON-LD, TTL] at the discretion of

the maintenance agency. See https:// www .iso .org/ maintenance _agencies .html #81140.

Any feedback or questions on this document should be directed to the user’s national standards body. A

complete listing of these bodies can be found at www .iso .org/ members .html.

iv © ISO 2021 – All rights reserved

Introduction

The classification of financial instruments (CFI) code was developed to address several problems

that concerned the financial community. With the growth of cross-border trading, the requirement to

improve communication of information among market participants had become critical.

The business problems centred around an inability to obtain information on financial instruments due

to the lack of a consistent and uniform approach to grouping financial instruments. With the explosive

growth over the previous 20 years in new instruments and features attached to financial instruments,

a serious communication problem had developed.

Many market participants were using similar terminology for instruments having significantly different

features. This problem was compounded when market participants looked beyond their own national

markets where they encountered the same words used to describe instruments with significantly

different features. Where the terminology was in a different language, market participants encountered

additional problems of translation, which can also be misleading.

In addition, the customs and practices of local markets varied considerably in how they structured

financial instruments, often leaving foreign participants perplexed. On careful analysis, it was often

found that the characteristics and features of these instruments were similar to domestic instruments.

However, most market participants did not have the time and resources to do this analysis.

The inability to group financial instruments in a consistent manner was another problem encountered

by market participants. Reports of holdings by different sources for similar financial instruments

often resulted in those instruments being categorized differently. This not only affected comparability

but caused a credibility issue with the reader. When relative performance is measured, the ability to

properly categorize holdings is essential if true comparisons are to be made.

A twofold solution was developed to address these problems. One was to establish a series of codes that

classify financial instruments having similar features. The other was to develop a glossary of terms and

provide common definitions that allow market participants to easily understand the terminology being

used.

The benefits derived are many:

— The CFI code system provides a set of codes for financial instruments that can be used globally

for straight-through processing by all involved participants in an electronic data processing

environment. For example, readers of portfolio holdings see reports from different sources using

the same categories, groups and attributes, making the comparison of instruments more credible.

— The use of these codes increases the efficiency, reliability, data consistency and transparency of

financial services transactions for both market and reference data. Classifying financial instruments

in a consistent, structured and standardized way is also beneficial for regulatory reporting

requirements.

— The broadened scope and coverage of CFI codes encourages market participants to take advantage of

other International Standards, particularly international securities identification numbers (ISINs).

— It is intended that the improved understanding of the characteristics and categorization leads to

a better understanding of financial instruments. This leads to more active markets and improved

market liquidity. In addition, these codes are displayed on websites using internet technology, which

has allowed the growth of e-issuing, e-trading and e-settlements.

— The CFI code system can further serve as a basis for the classification of financial instruments for

industry risk aggregation and regulatory reporting.

The International Organization for Standardization (ISO) draws attention to the fact that it is claimed

that compliance with this document may involve the use of a patent.

ISO takes no position concerning the evidence, validity and scope of this patent right.

The holder of this patent right has assured ISO that he or she is willing to negotiate licences under

reasonable and non-discriminatory terms and conditions with applicants throughout the world. In

this respect, the statement of the holder of this patent right is registered with ISO. Information may be

obtained from the patent database available at www .iso .org/ patents.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights other than those in the patent database. ISO shall not be held responsible for identifying

...

INTERNATIONAL ISO

STANDARD 10962

Redline version

compares ISO 10962:2021

to ISO 10962:2019

Securities and related financial

instruments — Classification of

financial instruments (CFI) code

Valeurs mobilières et autres instruments financiers concernés —

Classification des instruments financiers (code CFI)

Reference number

ISO 10962:redline:2021(E)

©

ISO 2021

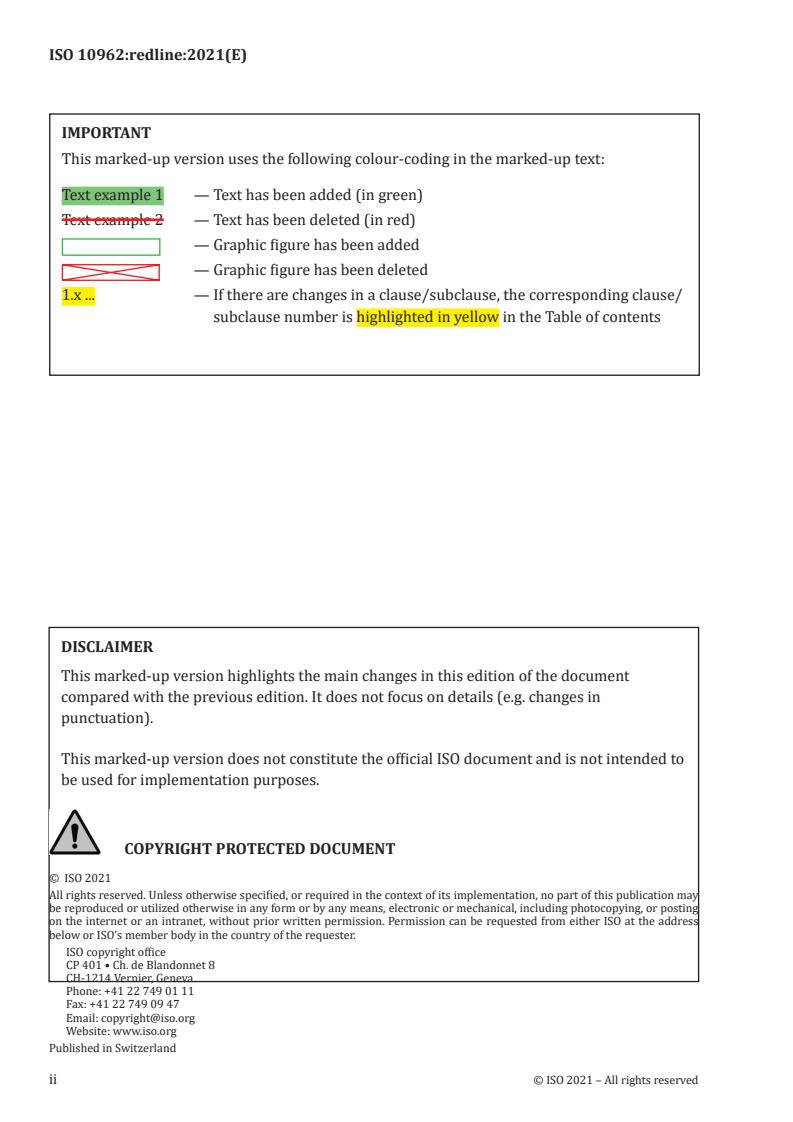

ISO 10962:redline:2021(E)

IMPORTANT

This marked-up version uses the following colour-coding in the marked-up text:

Text example 1 — Text has been added (in green)

— Text has been deleted (in red)

Text example 2

— Graphic figure has been added

— Graphic figure has been deleted

1.x . — If there are changes in a clause/subclause, the corresponding clause/

subclause number is highlighted in yellow in the Table of contents

DISCLAIMER

This marked-up version highlights the main changes in this edition of the document

compared with the previous edition. It does not focus on details (e.g. changes in

punctuation).

This marked-up version does not constitute the official ISO document and is not intended to

be used for implementation purposes.

© ISO 2021

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Fax: +41 22 749 09 47

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2021 – All rights reserved

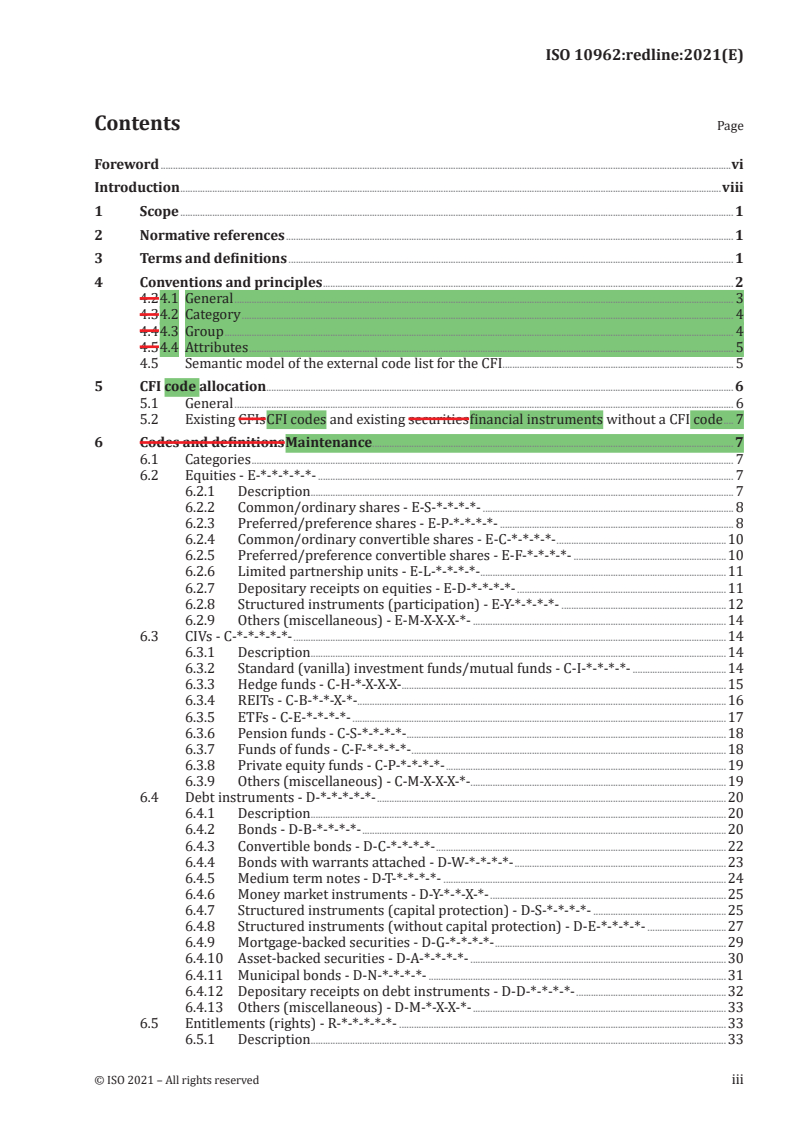

ISO 10962:redline:2021(E)

Contents Page

Foreword .vi

Introduction .viii

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Conventions and principles . 2

4.2 4.1 General . 3

4.3 4.2 Category . 4

4.4 4.3 Group . 4

4.5 4.4 Attributes . 5

4.5 Semantic model of the external code list for the CFI . 5

5 CFI code allocation . 6

5.1 General . 6

5.2 Existing CFIs CFI codes and existing securities financial instruments without a CFI code . 7

6 Codes and definitions Maintenance. 7

6.1 Categories . 7

6.2 Equities - E-*-*-*-*-*- . 7

6.2.1 Description . . . 7

6.2.2 Common/ordinary shares - E-S-*-*-*-*- . 8

6.2.3 Preferred/preference shares - E-P-*-*-*-*- . 8

6.2.4 Common/ordinary convertible shares - E-C-*-*-*-*- .10

6.2.5 Preferred/preference convertible shares - E-F-*-*-*-*- .10

6.2.6 Limited partnership units - E-L-*-*-*-*- . .11

6.2.7 Depositary receipts on equities - E-D-*-*-*-*- .11

6.2.8 Structured instruments (participation) - E-Y-*-*-*-*- .12

6.2.9 Others (miscellaneous) - E-M-X-X-X-*- .14

6.3 CIVs - C-*-*-*-*-*- .14

6.3.1 Description . . .14

6.3.2 Standard (vanilla) investment funds/mutual funds - C-I-*-*-*-*- .14

6.3.3 Hedge funds - C-H-*-X-X-X- .15

6.3.4 REITs - C-B-*-*-X-*-.16

6.3.5 ETFs - C-E-*-*-*-*- .17

6.3.6 Pension funds - C-S-*-*-*-*- .18

6.3.7 Funds of funds - C-F-*-*-*-*- .18

6.3.8 Private equity funds - C-P-*-*-*-*- .19

6.3.9 Others (miscellaneous) - C-M-X-X-X-*-.19

6.4 Debt instruments - D-*-*-*-*-*- .20

6.4.1 Description . . .20

6.4.2 Bonds - D-B-*-*-*-*- .20

6.4.3 Convertible bonds - D-C-*-*-*-*- .22

6.4.4 Bonds with warrants attached - D-W-*-*-*-*- .23

6.4.5 Medium term notes - D-T-*-*-*-*- .24

6.4.6 Money market instruments - D-Y-*-*-X-*- .25

6.4.7 Structured instruments (capital protection) - D-S-*-*-*-*- .25

6.4.8 Structured instruments (without capital protection) - D-E-*-*-*-*- .27

6.4.9 Mortgage-backed securities - D-G-*-*-*-*- .29

6.4.10 Asset-backed securities - D-A-*-*-*-*- .30

6.4.11 Municipal bonds - D-N-*-*-*-*- .31

6.4.12 Depositary receipts on debt instruments - D-D-*-*-*-*- .32

6.4.13 Others (miscellaneous) - D-M-*-X-X-*- .33

6.5 Entitlements (rights) - R-*-*-*-*-*- .33

6.5.1 Description . . .33

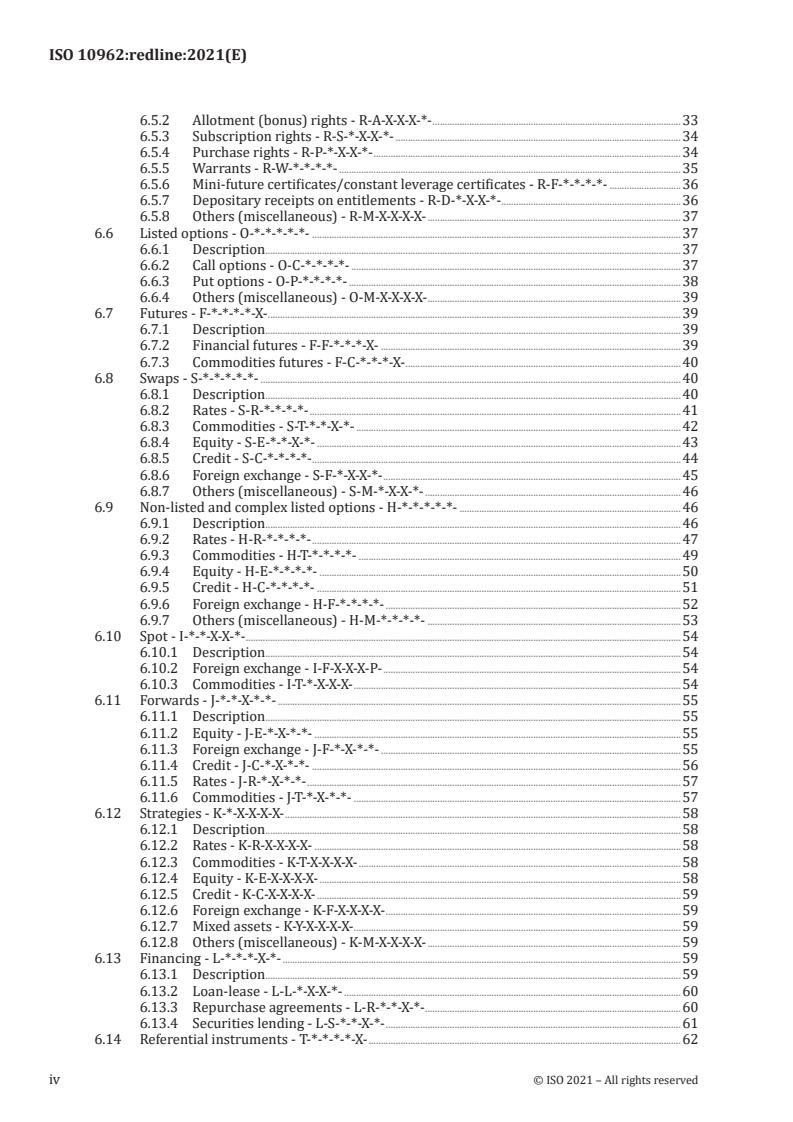

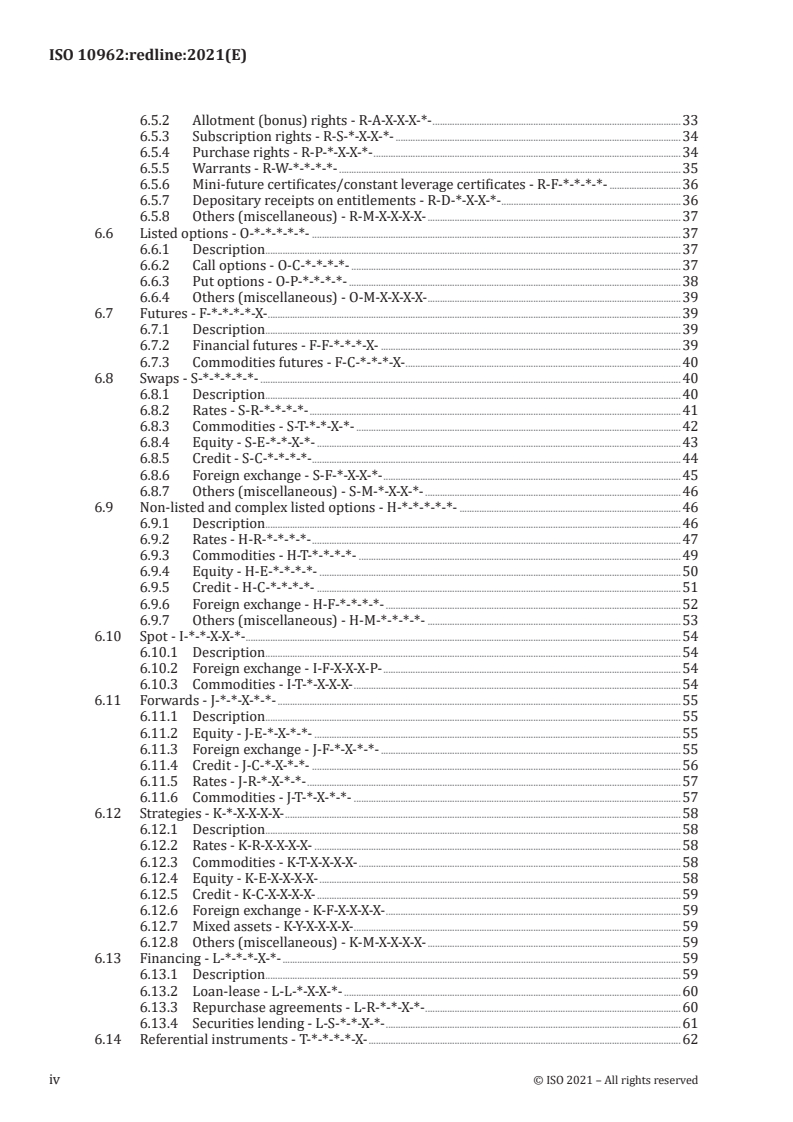

ISO 10962:redline:2021(E)

6.5.2 Allotment (bonus) rights - R-A-X-X-X-*- .33

6.5.3 Subscription rights - R-S-*-X-X-*- .34

6.5.4 Purchase rights - R-P-*-X-X-*- .34

6.5.5 Warrants - R-W-*-*-*-*- .35

6.5.6 Mini-future certificates/constant leverage certificates - R-F-*-*-*-*- .36

6.5.7 Depositary receipts on entitlements - R-D-*-X-X-*- .36

6.5.8 Others (miscellaneous) - R-M-X-X-X-X- .37

6.6 Listed options - O-*-*-*-*-*- .37

6.6.1 Description . . .37

6.6.2 Call options - O-C-*-*-*-*- .37

6.6.3 Put options - O-P-*-*-*-*- .38

6.6.4 Others (miscellaneous) - O-M-X-X-X-X- .39

6.7 Futures - F-*-*-*-*-X- .39

6.7.1 Description . . .39

6.7.2 Financial futures - F-F-*-*-*-X- .39

6.7.3 Commodities futures - F-C-*-*-*-X- .40

6.8 Swaps - S-*-*-*-*-*- .40

6.8.1 Description . . .40

6.8.2 Rates - S-R-*-*-*-*- .41

6.8.3 Commodities - S-T-*-*-X-*- .42

6.8.4 Equity - S-E-*-*-X-*- .43

6.8.5 Credit - S-C-*-*-*-*- . .44

6.8.6 Foreign exchange - S-F-*-X-X-*- .45

6.8.7 Others (miscellaneous) - S-M-*-X-X-*- .46

6.9 Non-listed and complex listed options - H-*-*-*-*-*- .46

6.9.1 Description . . .46

6.9.2 Rates - H-R-*-*-*-*- .47

6.9.3 Commodities - H-T-*-*-*-*- .49

6.9.4 Equity - H-E-*-*-*-*- .50

6.9.5 Credit - H-C-*-*-*-*- .51

6.9.6 Foreign exchange - H-F-*-*-*-*- .52

6.9.7 Others (miscellaneous) - H-M-*-*-*-*- .53

6.10 Spot - I-*-*-X-X-*- .54

6.10.1 Description . . .54

6.10.2 Foreign exchange - I-F-X-X-X-P- .54

6.10.3 Commodities - I-T-*-X-X-X- .54

6.11 Forwards - J-*-*-X-*-*- .55

6.11.1 Description . . .55

6.11.2 Equity - J-E-*-X-*-*- .55

6.11.3 Foreign exchange - J-F-*-X-*-*- .55

6.11.4 Credit - J-C-*-X-*-*- .56

6.11.5 Rates - J-R-*-X-*-*- .57

6.11.6 Commodities - J-T-*-X-*-*- .57

6.12 Strategies - K-*-X-X-X-X- .58

6.12.1 Description . . .58

6.12.2 Rates - K-R-X-X-X-X- .58

6.12.3 Commodities - K-T-X-X-X-X- .58

6.12.4 Equity - K-E-X-X-X-X- .58

6.12.5 Credit - K-C-X-X-X-X- .59

6.12.6 Foreign exchange - K-F-X-X-X-X- .59

6.12.7 Mixed assets - K-Y-X-X-X-X- .59

6.12.8 Others (miscellaneous) - K-M-X-X-X-X- .59

6.13 Financing - L-*-*-*-X-*- .59

6.13.1 Description . . .59

6.13.2 Loan-lease - L-L-*-X-X-*- .60

6.13.3 Repurchase agreements - L-R-*-*-X-*- .60

6.13.4 Securities lending - L-S-*-*-X-*- .61

6.14 Referential instruments - T-*-*-*-*-X- .62

iv © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

6.14.1 Description . . .62

6.14.2 Currencies - T-C-*-X-X-X- .62

6.14.3 Commodities - T-T-*-X-X-X- .62

6.14.4 Interest rates - T-R-*-*-X-X- . .63

6.14.5 Indices - T-I-*-*-*-X- .63

6.14.6 Baskets - T-B-*-X-X-X- . .64

6.14.7 Stock dividends - T-D-*-X-X-X- .65

6.14.8 Others (miscellaneous) - T-M-X-X-X-X- .65

6.15 Others (miscellaneous) - M-*-*-*-X-*- .65

6.15.1 Description . . .65

6.15.2 Combined instruments - M-C-*-*-X-*- .65

6.15.3 Other assets - M-M-*-X-X-X- .66

Annex A

(informative)

Classification examples .67

Bibliography .74

ISO 10962:redline:2021(E)

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular, the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation of the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT), see www .iso .org/

iso/ foreword .htmlwww .iso .org/ iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 8,

Reference data for financial services.

This fourthfifth edition cancels and replaces the thirdfourth edition (ISO 10962:20152019), which

has been technically revised. The main changes to the previous edition are as follows: six -character

hierarchical structure remains unchanged from the previous version.

The main changes to the previous edition are as follows:

— The CFI code list has been removed from the specification and moved to an external code list.

— To address industry requirements for the classification of derivative instruments,The structure of

the CFI and content of 6.8, 6.9 and 6.11 have been amended, where the support for multi-commodity

derivatives, the addition of exercise styles not connected to option type (put or call) and the

ability to classify foreign exchange derivatives for single currencies and a basket of currencies are

includedthe code list are captured in the form of a machine-readable semantical model of the code

lists and their values. It is important to understand that this is a semantic representation of the CFI

hierarchical structure and not a canonical semantic classification of financial instruments, which is

beyond the scope of this document.

— In 6.8The CFI external code list is maintained and published by the ISO 10962, changes have been

introduced for the identification of deliverable/non-deliverable for swap products. maintenance

agency, which is responsible for managing the modification and enhancement of the code lists, their

values and corresponding descriptions. The maintenance agency is responsible for publishing the

CFI code list. The CFI external code list is published in a selection of human-readable and machine-

readable data formats [e.g. spreadsheet, PDF, comma-separated values (CSV), JSON-LD, TTL] at

the discretion of the maintenance agency. See https:// www .iso .org/ maintenance _agencies .html

#81140.

— Rolling foreign exchange spot contracts have been included in 6.11.

vi © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

Any feedback or questions on this document should be directed to the user’s national standards body. A

complete listing of these bodies can be found at www .iso .org/ members .html.

ISO 10962:redline:2021(E)

Introduction

The classification of financial instruments (CFI) code was developed to address a number of problems

which haveseveral problems that concerned the financial community. With the growth of cross-border

trading, the requirement to improve communication of information among market participants hashad

become critical.

The business problems centrecentred around an inability to obtain information on securitiesfinancial

instruments due to the lack of a consistent and uniform approach to grouping financial instruments.

With the explosive growth over the pastprevious 20 years in new instruments and features attached to

financial instruments, a serious communication problem hashad developed.

Many market participants arewere using similar terminology for instruments having significantly

different features. The problem isThis problem was compounded when market participants looklooked

beyond their own national markets. They encounter where they encountered the same words used to

describe instruments in another country, which havewith significantly different features. Where the

terminology iswas in a different language, the market participant encounters the problem of the same

words being applied to different instruments along with themarket participants encountered additional

problems of translation, which also can also be misleading.

In addition, the customs and practices of local markets varyvaried considerably in the manner in which

they structurehow they structured financial instruments, often leaving foreign participants confused

and perplexed. On careful analysis, it iswas often found that the characteristics and features of these

instruments arewere similar to a domestic instrumentinstruments. However, most market participants

dodid not have the time and resources to do this analysis.

The inability to group securitiesfinancial instruments in a consistent manner iswas another problem

encountered by market participants. Reports of holdings by different sources for similar financial

instruments often result in financialresulted in those instruments being categorized differently. This

not only affectsaffected comparability but causescaused a credibility issue with the reader. When

relative performances are beingperformance is measured, the ability to properly categorize holdings is

essential if true comparisons are to be made.

The solution envisioned is twofold. One isA twofold solution was developed to address these problems.

One was to establish a series of codes which clearlythat classify financial instruments having similar

features. The other iswas to develop a glossary of terms and provide common definitions whichthat

allow market participants to easily understand the terminology being used.

The benefits derived are many:

— The development of these codes will increase the efficiency, reliability, data consistency and

transparency of financial services transactions for both market and reference data. Classifying

financial instruments in a consistent, structured and standardized way is also beneficial for

regulatory reporting requirements.

— The CFI code system provides a set of codes for financial instruments whichthat can be used

globally for straight-through processing by all involved participants in an electronic data processing

environment. For example, readers of portfolio holdings see reports from different sources using

the same Categories, Groups and Attributes, makingcategories, groups and attributes, making the

comparison of instruments more credible.

— The use of these codes increases the efficiency, reliability, data consistency and transparency of

financial services transactions for both market and reference data. Classifying financial instruments

in a consistent, structured and standardized way is also beneficial for regulatory reporting

requirements.

— The broadened scope and coverage of CFI codes encourages market participants to take advantage of

other International Standards, particularly international securities identification numbers (ISINs).

viii © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

— It is intended that the improved understanding of the characteristics and categorization leads to a

better comprehensionunderstanding of financial instruments. This leads to more active markets

and the resulting improvement inimproved market liquidity. In addition, these codes will beare

displayed on websites using internet technology, which has allowed the growth of e-issuing,

e-trading and e-settlements.

— The CFI code system can further serve as a basis for the classification of financial instruments for

industry risk aggregation and regulatory reporting.

The International Organization for Standardization (ISO) draws attention to the fact that it is claimed

that compliance with this document may involve the use of a patent.

ISO takes no position concerning the evidence, validity and scope of this patent right.

The holder of this patent right has assured ISO that he or she is willing to negotiate licences under

reasonable and non-discriminatory terms and conditions with applicants throughout the world. In

this respect, the statement of the holder of this patent right is registered with ISO. Information may be

obtained from the patent database available at www .iso .org/ patents.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights other than those in the patent database. ISO shall not be held responsible for identifying

any or all such patent rights.

INTERNATIONAL STANDARD ISO 10962:redline:2021(E)

Securities and related financial instruments —

Classification of financial instruments (CFI) code

1 Scope

This document defines and describes the structure for the codes for an internationally valid system

to classify financial instruments. The classification system applies to financial instruments negotiated

internationally as well as to domestic instruments. The term “financial instruments” refers not only to

classical securities, and derivatives but also covers the innovative financial products that have emerged

in different markets (a trend that is expected to continue in the future).

This document is intended for use in any application in the trading and administration of

securitiesfinancial instruments in the international securities business. In so farInsofar as the trading

and the administration of securities do not affect other countries, the application of this document

remains at the discretion of the responsible national bodies, such as stock exchanges, banks, brokers,

regulatory bodies and other institutions active in the securities field.

In principle, the CFI code reflects characteristics that are defined when a financial instrument is issued

and that remain unchanged during its entire lifetime. However, a few events that can lead to a new

CFI code for the same instrument are anticipated, such as the changing of voting rights or ownership

restrictions by a stockholders' meeting.

2 Normative references

The following documents are referred to in the text in such a way that some or all of their content

constitutes requirements ofThere are no normative references in this document. For dated references,

only the edition cited applies. For undated references, the latest edition of the referenced document

(including any amendments) applies.

ISO 6166, Securities and related financial instruments — International securities identification numbering

system (ISIN)

3 Terms and definitions

NoFor the purposes of this document, the following terms and definitions are listed in this

documentapply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

— ISO Online browsing platform: available at https:// www .iso .org/ obphttps:// www .iso .org/ obp

— IEC Electropedia: available at http:// www .electropedia .org/

3.1

concept

unit thought, idea or meaning

Note 1 to entry: A concept uses an Internationalized Resource Identifier (3.2) as a unique identifier.

ISO 10962:redline:2021(E)

3.2

Internationalized Resource Identifier

IRI

unique string of characters to identify a concept (3.1)

Note 1 to entry: The IRI supersedes the universal resource identifier (URI) for use in identifying concepts within

a Resource Definition Framework (3.3).

3.3

Resource Definition Framework

RDF

general method used to model concepts (3.1)

3.4

Web Ontology Language

OWL

semantic web language designed to represent rich and complex knowledge about things, groups of

things and relations between things, allowing one to represent hierarchical class relationships and

capture properties and constraints, among other things

Note 1 to entry: Further information is provided at: https:// www .w3 .org/ OWL/ . There are various syntax

conventions by which OWL can be represented [see Terse RDF Triple Language (3.6)].

Note 2 to entry: Any terms that are part of this vocabulary are prefixed with owl:.

3.5

Simple Knowledge Organization System

SKOS

W3C recommendation designed for representing classification schemes and taxonomies

Note 1 to entry: Like OWL, SKOS is an RDF-based vocabulary.

Note 2 to entry: Unlike the class hierarchy one can develop in OWL, SKOS provides the ability to create

hierarchies that utilize different types of relationships, e.g. is-a-part/member-of and as such, and also provides

the opportunity to support classifications and taxonomies across a broad range of information and use cases.

Note 3 to entry: Further information is provided at: https:// www .w3 .org/ SKOS/ .

Note 4 to entry: Any terms that are part of this vocabulary are prefixed with skos:.

3.6

Terse RDF Triple Language

TTL

syntax convention that represents the Web Ontology Language (3.4)

Note 1 to entry: Further information on this OWL syntax and details regarding how it is structured is provided

at: https:// www .w3 .org/ TeamSubmission/ turtle/ .

4 Conventions and principles

4.1 The CFI code provides the most comprehensive information possible, while maintaining the code

manageability. One of the essential rules of this CFI concept is that the classification is determined by

the intrinsic characteristics of the respective financial instruments and not by the instrument names and

terms prevailing in a given country; these terms can possibly be used in a different sense in another

country. This principle avoids confusion arising from different linguistic usage as well as redundancy,

while allowing objective comparison of the instruments across all domestic markets.

Refer to the examples in Annex A.

2 © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

4.2 4.1 General

The CFI code provides the most comprehensive information possible while maintaining the

manageability of the code. One of the essential rules of this CFI concept is that the classification is

determined by the intrinsic characteristics of the respective financial instruments and not by the

instrument names and terms prevailing in a given country; these terms can be used in a different sense

in another country. This principle avoids confusion arising from different linguistic usage as well as

redundancy, while allowing objective comparison of the instruments across all domestic markets.

The CFI code should be defined in such a way that there is only one possible unique CFI code per type of

financial instrument. The CFI code should have a one-to-many relationship with financial instruments.

A financial instrument should only be associated with a single CFI code, see Figure 1.

Key

concepts or entities not defined within TC 68/SC 8 standards as of publication of this document

entity defined by an ISO standard

relationship between entities

Cardinality rules

0.* (optional, zero or more)

1.1 (one to one)

Figure 1 — Entity relationship

The CFI code is composed of six alphabetic characters where each character position has special

significance. The structure can be summarized as follows (detailed descriptions are provided in the

following subclauses):

— The first character represents the Category of the instrument.

ISO 10962:redline:2021(E)

— The second character represents the Group within a given Category.

— The third to the sixth characters are attributes which are defined to be significant within the context

of a given Category and Group.

The CFI code consists of six alphabetical characters. The following alphabetic characters,alphabetic

characters A, B, C, D, E, F, G, H, I, J, K, L, M, N, O, P, Q, R, S, T, U, V, W, X, Y and Z are available for assignment.

Two alphabetic characters have special meaningmeanings and cannot be redefined:

X Not applicable/ or undefined: the character 'X' may be used for any respective Attribute if the infor-

mation is unknown, not available or applicable at the time of assignment, regardless of whether it

is stated as an available character for the Attribute and should be updated to reflect the respective

Attribute as soon as it is known or available.

The character 'X' shall not be used as a value in the above describedthis manner for Category or

Group.

M Others (miscellaneous): the character ‘M’ exclusively represents ‘Others (miscellaneous)’ and may

only be used where it is available as a character within the context of its parent category or group.

‘M’ is only to be selected when the Category, Group or Attribute being classified cannot shall not

be attributed to an existing specified Category, Group or Attribute.

The meaning of an alphabetic character is local to, and only valid within, the context of its parent

Category or Groupcategory or its group.

Refer to Annex A for an example.

4.3 4.2 Category

The first character indicates the highest level of classification and differentiates between Categories

such as equities, collective investment vehicles (CIVs), debt instruments and many more, the Category,

which describes the broad asset classes of the instrument, such as debt, equities, listed options,

referential instruments or swaps.

4.4 4.3 Group

The second character indicates specific Groups within each Category; equities, for example,category.

For example, equities are broken down into: groups such as common or ordinary shares, preferred

or preference shares, and common or ordinary convertible shares. Within the category of debt

instruments, groups include bonds and convertible bonds.

— common/ordinary shares,

— preferred/preference shares,

— common/ordinary convertible shares,

— preferred/preference convertible shares,

— limited partnership units,

— depositary receipts on equities,

— structured instruments (participation) and

— others (miscellaneous).

Within the Category of debt instruments, the Groups are bonds, convertible bonds, bonds with warrants

attached, medium-term notes, money market instruments, structured instruments (capital protection),

structured instruments (without capital protection), mortgage-backed securities, asset-backed

securities, municipal bonds, depositary receipts on debt instruments and others (miscellaneous).

4 © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

For the complete classification breakdown covering all categories, see Clause 6https://www .iso .org/

maintenance _agencies .html #81140.

4.5 4.4 Attributes

The last four characters indicate the most relevant attributes applicable to each Groupgroup within

a category. Whereas voting rights, ownership/transfer/, transfer or sales restrictions, payment status

and form are useful information in equities, these features do not exist for options, which have other

attributes such as option style, underlying assets, delivery, standardized/ or non-standardized, or

trigger. The position of the four attributes among them do not represent a hierarchical structure within

the instrument group.

4.5 Semantic model of the external code list for the CFI

The metamodel for the CFI consists of a specification of each type of CFI component (e.g. Category,

Group, First Attribute) as well as the metadata that is attached to each of those components. The

anno

...

INTERNATIONAL ISO

STANDARD 10962

Fifth edition

2021-05

Securities and related financial

instruments — Classification of

financial instruments (CFI) code

Valeurs mobilières et autres instruments financiers concernés —

Classification des instruments financiers (code CFI)

Reference number

©

ISO 2021

© ISO 2021

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2021 – All rights reserved

Contents Page

Foreword .iv

Introduction .v

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Conventions and principles . 2

4.1 General . 2

4.2 Category . 4

4.3 Group . 4

4.4 Attributes . 4

4.5 Semantic model of the external code list for the CFI . 4

5 CFI code allocation . 6

5.1 General . 6

5.2 Existing CFI codes and existing financial instruments without a CFI code . 7

6 Maintenance . 7

Annex A (informative) Classification examples. 8

Bibliography . 9

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular, the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation of the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT), see www .iso .org/

iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 8,

Reference data for financial services.

This fifth edition cancels and replaces the fourth edition (ISO 10962:2019), which has been technically

revised. The six-character hierarchical structure remains unchanged from the previous version.

The main changes to the previous edition are as follows:

— The CFI code list has been removed from the specification and moved to an external code list.

— The structure of the CFI and content of the code list are captured in the form of a machine-readable

semantical model of the code lists and their values. It is important to understand that this is a

semantic representation of the CFI hierarchical structure and not a canonical semantic classification

of financial instruments, which is beyond the scope of this document.

— The CFI external code list is maintained and published by the ISO 10962 maintenance agency, which

is responsible for managing the modification and enhancement of the code lists, their values and

corresponding descriptions. The maintenance agency is responsible for publishing the CFI code list.

The CFI external code list is published in a selection of human-readable and machine-readable data

formats [e.g. spreadsheet, PDF, comma-separated values (CSV), JSON-LD, TTL] at the discretion of

the maintenance agency. See https:// www .iso .org/ maintenance _agencies .html #81140.

Any feedback or questions on this document should be directed to the user’s national standards body. A

complete listing of these bodies can be found at www .iso .org/ members .html.

iv © ISO 2021 – All rights reserved

Introduction

The classification of financial instruments (CFI) code was developed to address several problems

that concerned the financial community. With the growth of cross-border trading, the requirement to

improve communication of information among market participants had become critical.

The business problems centred around an inability to obtain information on financial instruments due

to the lack of a consistent and uniform approach to grouping financial instruments. With the explosive

growth over the previous 20 years in new instruments and features attached to financial instruments,

a serious communication problem had developed.

Many market participants were using similar terminology for instruments having significantly different

features. This problem was compounded when market participants looked beyond their own national

markets where they encountered the same words used to describe instruments with significantly

different features. Where the terminology was in a different language, market participants encountered

additional problems of translation, which can also be misleading.

In addition, the customs and practices of local markets varied considerably in how they structured

financial instruments, often leaving foreign participants perplexed. On careful analysis, it was often

found that the characteristics and features of these instruments were similar to domestic instruments.

However, most market participants did not have the time and resources to do this analysis.

The inability to group financial instruments in a consistent manner was another problem encountered

by market participants. Reports of holdings by different sources for similar financial instruments

often resulted in those instruments being categorized differently. This not only affected comparability

but caused a credibility issue with the reader. When relative performance is measured, the ability to

properly categorize holdings is essential if true comparisons are to be made.

A twofold solution was developed to address these problems. One was to establish a series of codes that

classify financial instruments having similar features. The other was to develop a glossary of terms and

provide common definitions that allow market participants to easily understand the terminology being

used.

The benefits derived are many:

— The CFI code system provides a set of codes for financial instruments that can be used globally

for straight-through processing by all involved participants in an electronic data processing

environment. For example, readers of portfolio holdings see reports from different sources using

the same categories, groups and attributes, making the comparison of instruments more credible.

— The use of these codes increases the efficiency, reliability, data consistency and transparency of

financial services transactions for both market and reference data. Classifying financial instruments

in a consistent, structured and standardized way is also beneficial for regulatory reporting

requirements.

— The broadened scope and coverage of CFI codes encourages market participants to take advantage of

other International Standards, particularly international securities identification numbers (ISINs).

— It is intended that the improved understanding of the characteristics and categorization leads to

a better understanding of financial instruments. This leads to more active markets and improved

market liquidity. In addition, these codes are displayed on websites using internet technology, which

has allowed the growth of e-issuing, e-trading and e-settlements.

— The CFI code system can further serve as a basis for the classification of financial instruments for

industry risk aggregation and regulatory reporting.

The International Organization for Standardization (ISO) draws attention to the fact that it is claimed

that compliance with this document may involve the use of a patent.

ISO takes no position concerning the evidence, validity and scope of this patent right.

The holder of this patent right has assured ISO that he or she is willing to negotiate licences under

reasonable and non-discriminatory terms and conditions with applicants throughout the world. In

this respect, the statement of the holder of this patent right is registered with ISO. Information may be

obtained from the patent database available at www .iso .org/ patents.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights other than those in the patent database. ISO shall not be held responsible for identifying

...

INTERNATIONAL ISO

STANDARD 10962

Redline version

compares ISO 10962:2021

to ISO 10962:2019

Securities and related financial

instruments — Classification of

financial instruments (CFI) code

Valeurs mobilières et autres instruments financiers concernés —

Classification des instruments financiers (code CFI)

Reference number

ISO 10962:redline:2021(E)

©

ISO 2021

ISO 10962:redline:2021(E)

IMPORTANT

This marked-up version uses the following colour-coding in the marked-up text:

Text example 1 — Text has been added (in green)

— Text has been deleted (in red)

Text example 2

— Graphic figure has been added

— Graphic figure has been deleted

1.x . — If there are changes in a clause/subclause, the corresponding clause/

subclause number is highlighted in yellow in the Table of contents

DISCLAIMER

This marked-up version highlights the main changes in this edition of the document

compared with the previous edition. It does not focus on details (e.g. changes in

punctuation).

This marked-up version does not constitute the official ISO document and is not intended to

be used for implementation purposes.

© ISO 2021

All rights reserved. Unless otherwise specified, or required in the context of its implementation, no part of this publication may

be reproduced or utilized otherwise in any form or by any means, electronic or mechanical, including photocopying, or posting

on the internet or an intranet, without prior written permission. Permission can be requested from either ISO at the address

below or ISO’s member body in the country of the requester.

ISO copyright office

CP 401 • Ch. de Blandonnet 8

CH-1214 Vernier, Geneva

Phone: +41 22 749 01 11

Fax: +41 22 749 09 47

Email: copyright@iso.org

Website: www.iso.org

Published in Switzerland

ii © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

Contents Page

Foreword .vi

Introduction .viii

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 1

4 Conventions and principles . 2

4.2 4.1 General . 3

4.3 4.2 Category . 4

4.4 4.3 Group . 4

4.5 4.4 Attributes . 5

4.5 Semantic model of the external code list for the CFI . 5

5 CFI code allocation . 6

5.1 General . 6

5.2 Existing CFIs CFI codes and existing securities financial instruments without a CFI code . 7

6 Codes and definitions Maintenance. 7

6.1 Categories . 7

6.2 Equities - E-*-*-*-*-*- . 7

6.2.1 Description . . . 7

6.2.2 Common/ordinary shares - E-S-*-*-*-*- . 8

6.2.3 Preferred/preference shares - E-P-*-*-*-*- . 8

6.2.4 Common/ordinary convertible shares - E-C-*-*-*-*- .10

6.2.5 Preferred/preference convertible shares - E-F-*-*-*-*- .10

6.2.6 Limited partnership units - E-L-*-*-*-*- . .11

6.2.7 Depositary receipts on equities - E-D-*-*-*-*- .11

6.2.8 Structured instruments (participation) - E-Y-*-*-*-*- .12

6.2.9 Others (miscellaneous) - E-M-X-X-X-*- .14

6.3 CIVs - C-*-*-*-*-*- .14

6.3.1 Description . . .14

6.3.2 Standard (vanilla) investment funds/mutual funds - C-I-*-*-*-*- .14

6.3.3 Hedge funds - C-H-*-X-X-X- .15

6.3.4 REITs - C-B-*-*-X-*-.16

6.3.5 ETFs - C-E-*-*-*-*- .17

6.3.6 Pension funds - C-S-*-*-*-*- .18

6.3.7 Funds of funds - C-F-*-*-*-*- .18

6.3.8 Private equity funds - C-P-*-*-*-*- .19

6.3.9 Others (miscellaneous) - C-M-X-X-X-*-.19

6.4 Debt instruments - D-*-*-*-*-*- .20

6.4.1 Description . . .20

6.4.2 Bonds - D-B-*-*-*-*- .20

6.4.3 Convertible bonds - D-C-*-*-*-*- .22

6.4.4 Bonds with warrants attached - D-W-*-*-*-*- .23

6.4.5 Medium term notes - D-T-*-*-*-*- .24

6.4.6 Money market instruments - D-Y-*-*-X-*- .25

6.4.7 Structured instruments (capital protection) - D-S-*-*-*-*- .25

6.4.8 Structured instruments (without capital protection) - D-E-*-*-*-*- .27

6.4.9 Mortgage-backed securities - D-G-*-*-*-*- .29

6.4.10 Asset-backed securities - D-A-*-*-*-*- .30

6.4.11 Municipal bonds - D-N-*-*-*-*- .31

6.4.12 Depositary receipts on debt instruments - D-D-*-*-*-*- .32

6.4.13 Others (miscellaneous) - D-M-*-X-X-*- .33

6.5 Entitlements (rights) - R-*-*-*-*-*- .33

6.5.1 Description . . .33

ISO 10962:redline:2021(E)

6.5.2 Allotment (bonus) rights - R-A-X-X-X-*- .33

6.5.3 Subscription rights - R-S-*-X-X-*- .34

6.5.4 Purchase rights - R-P-*-X-X-*- .34

6.5.5 Warrants - R-W-*-*-*-*- .35

6.5.6 Mini-future certificates/constant leverage certificates - R-F-*-*-*-*- .36

6.5.7 Depositary receipts on entitlements - R-D-*-X-X-*- .36

6.5.8 Others (miscellaneous) - R-M-X-X-X-X- .37

6.6 Listed options - O-*-*-*-*-*- .37

6.6.1 Description . . .37

6.6.2 Call options - O-C-*-*-*-*- .37

6.6.3 Put options - O-P-*-*-*-*- .38

6.6.4 Others (miscellaneous) - O-M-X-X-X-X- .39

6.7 Futures - F-*-*-*-*-X- .39

6.7.1 Description . . .39

6.7.2 Financial futures - F-F-*-*-*-X- .39

6.7.3 Commodities futures - F-C-*-*-*-X- .40

6.8 Swaps - S-*-*-*-*-*- .40

6.8.1 Description . . .40

6.8.2 Rates - S-R-*-*-*-*- .41

6.8.3 Commodities - S-T-*-*-X-*- .42

6.8.4 Equity - S-E-*-*-X-*- .43

6.8.5 Credit - S-C-*-*-*-*- . .44

6.8.6 Foreign exchange - S-F-*-X-X-*- .45

6.8.7 Others (miscellaneous) - S-M-*-X-X-*- .46

6.9 Non-listed and complex listed options - H-*-*-*-*-*- .46

6.9.1 Description . . .46

6.9.2 Rates - H-R-*-*-*-*- .47

6.9.3 Commodities - H-T-*-*-*-*- .49

6.9.4 Equity - H-E-*-*-*-*- .50

6.9.5 Credit - H-C-*-*-*-*- .51

6.9.6 Foreign exchange - H-F-*-*-*-*- .52

6.9.7 Others (miscellaneous) - H-M-*-*-*-*- .53

6.10 Spot - I-*-*-X-X-*- .54

6.10.1 Description . . .54

6.10.2 Foreign exchange - I-F-X-X-X-P- .54

6.10.3 Commodities - I-T-*-X-X-X- .54

6.11 Forwards - J-*-*-X-*-*- .55

6.11.1 Description . . .55

6.11.2 Equity - J-E-*-X-*-*- .55

6.11.3 Foreign exchange - J-F-*-X-*-*- .55

6.11.4 Credit - J-C-*-X-*-*- .56

6.11.5 Rates - J-R-*-X-*-*- .57

6.11.6 Commodities - J-T-*-X-*-*- .57

6.12 Strategies - K-*-X-X-X-X- .58

6.12.1 Description . . .58

6.12.2 Rates - K-R-X-X-X-X- .58

6.12.3 Commodities - K-T-X-X-X-X- .58

6.12.4 Equity - K-E-X-X-X-X- .58

6.12.5 Credit - K-C-X-X-X-X- .59

6.12.6 Foreign exchange - K-F-X-X-X-X- .59

6.12.7 Mixed assets - K-Y-X-X-X-X- .59

6.12.8 Others (miscellaneous) - K-M-X-X-X-X- .59

6.13 Financing - L-*-*-*-X-*- .59

6.13.1 Description . . .59

6.13.2 Loan-lease - L-L-*-X-X-*- .60

6.13.3 Repurchase agreements - L-R-*-*-X-*- .60

6.13.4 Securities lending - L-S-*-*-X-*- .61

6.14 Referential instruments - T-*-*-*-*-X- .62

iv © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

6.14.1 Description . . .62

6.14.2 Currencies - T-C-*-X-X-X- .62

6.14.3 Commodities - T-T-*-X-X-X- .62

6.14.4 Interest rates - T-R-*-*-X-X- . .63

6.14.5 Indices - T-I-*-*-*-X- .63

6.14.6 Baskets - T-B-*-X-X-X- . .64

6.14.7 Stock dividends - T-D-*-X-X-X- .65

6.14.8 Others (miscellaneous) - T-M-X-X-X-X- .65

6.15 Others (miscellaneous) - M-*-*-*-X-*- .65

6.15.1 Description . . .65

6.15.2 Combined instruments - M-C-*-*-X-*- .65

6.15.3 Other assets - M-M-*-X-X-X- .66

Annex A

(informative)

Classification examples .67

Bibliography .74

ISO 10962:redline:2021(E)

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular, the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www .iso .org/ directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www .iso .org/ patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation of the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT), see www .iso .org/

iso/ foreword .htmlwww .iso .org/ iso/ foreword .html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 8,

Reference data for financial services.

This fourthfifth edition cancels and replaces the thirdfourth edition (ISO 10962:20152019), which

has been technically revised. The main changes to the previous edition are as follows: six -character

hierarchical structure remains unchanged from the previous version.

The main changes to the previous edition are as follows:

— The CFI code list has been removed from the specification and moved to an external code list.

— To address industry requirements for the classification of derivative instruments,The structure of

the CFI and content of 6.8, 6.9 and 6.11 have been amended, where the support for multi-commodity

derivatives, the addition of exercise styles not connected to option type (put or call) and the

ability to classify foreign exchange derivatives for single currencies and a basket of currencies are

includedthe code list are captured in the form of a machine-readable semantical model of the code

lists and their values. It is important to understand that this is a semantic representation of the CFI

hierarchical structure and not a canonical semantic classification of financial instruments, which is

beyond the scope of this document.

— In 6.8The CFI external code list is maintained and published by the ISO 10962, changes have been

introduced for the identification of deliverable/non-deliverable for swap products. maintenance

agency, which is responsible for managing the modification and enhancement of the code lists, their

values and corresponding descriptions. The maintenance agency is responsible for publishing the

CFI code list. The CFI external code list is published in a selection of human-readable and machine-

readable data formats [e.g. spreadsheet, PDF, comma-separated values (CSV), JSON-LD, TTL] at

the discretion of the maintenance agency. See https:// www .iso .org/ maintenance _agencies .html

#81140.

— Rolling foreign exchange spot contracts have been included in 6.11.

vi © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

Any feedback or questions on this document should be directed to the user’s national standards body. A

complete listing of these bodies can be found at www .iso .org/ members .html.

ISO 10962:redline:2021(E)

Introduction

The classification of financial instruments (CFI) code was developed to address a number of problems

which haveseveral problems that concerned the financial community. With the growth of cross-border

trading, the requirement to improve communication of information among market participants hashad

become critical.

The business problems centrecentred around an inability to obtain information on securitiesfinancial

instruments due to the lack of a consistent and uniform approach to grouping financial instruments.

With the explosive growth over the pastprevious 20 years in new instruments and features attached to

financial instruments, a serious communication problem hashad developed.

Many market participants arewere using similar terminology for instruments having significantly

different features. The problem isThis problem was compounded when market participants looklooked

beyond their own national markets. They encounter where they encountered the same words used to

describe instruments in another country, which havewith significantly different features. Where the

terminology iswas in a different language, the market participant encounters the problem of the same

words being applied to different instruments along with themarket participants encountered additional

problems of translation, which also can also be misleading.

In addition, the customs and practices of local markets varyvaried considerably in the manner in which

they structurehow they structured financial instruments, often leaving foreign participants confused

and perplexed. On careful analysis, it iswas often found that the characteristics and features of these

instruments arewere similar to a domestic instrumentinstruments. However, most market participants

dodid not have the time and resources to do this analysis.

The inability to group securitiesfinancial instruments in a consistent manner iswas another problem

encountered by market participants. Reports of holdings by different sources for similar financial

instruments often result in financialresulted in those instruments being categorized differently. This

not only affectsaffected comparability but causescaused a credibility issue with the reader. When

relative performances are beingperformance is measured, the ability to properly categorize holdings is

essential if true comparisons are to be made.

The solution envisioned is twofold. One isA twofold solution was developed to address these problems.

One was to establish a series of codes which clearlythat classify financial instruments having similar

features. The other iswas to develop a glossary of terms and provide common definitions whichthat

allow market participants to easily understand the terminology being used.

The benefits derived are many:

— The development of these codes will increase the efficiency, reliability, data consistency and

transparency of financial services transactions for both market and reference data. Classifying

financial instruments in a consistent, structured and standardized way is also beneficial for

regulatory reporting requirements.

— The CFI code system provides a set of codes for financial instruments whichthat can be used

globally for straight-through processing by all involved participants in an electronic data processing

environment. For example, readers of portfolio holdings see reports from different sources using

the same Categories, Groups and Attributes, makingcategories, groups and attributes, making the

comparison of instruments more credible.

— The use of these codes increases the efficiency, reliability, data consistency and transparency of

financial services transactions for both market and reference data. Classifying financial instruments

in a consistent, structured and standardized way is also beneficial for regulatory reporting

requirements.

— The broadened scope and coverage of CFI codes encourages market participants to take advantage of

other International Standards, particularly international securities identification numbers (ISINs).

viii © ISO 2021 – All rights reserved

ISO 10962:redline:2021(E)

— It is intended that the improved understanding of the characteristics and categorization leads to a

better comprehensionunderstanding of financial instruments. This leads to more active markets

and the resulting improvement inimproved market liquidity. In addition, these codes will beare

displayed on websites using internet technology, which has allowed the growth of e-issuing,

e-trading and e-settlements.

— The CFI code system can further serve as a basis for the classification of financial instruments for

industry risk aggregation and regulatory reporting.

The International Organization for Standardization (ISO) draws attention to the fact that it is claimed

that compliance with this document may involve the use of a patent.

ISO takes no position concerning the evidence, validity and scope of this patent right.

The holder of this patent right has assured ISO that he or she is willing to negotiate licences under

reasonable and non-discriminatory terms and conditions with applicants throughout the world. In

this respect, the statement of the holder of this patent right is registered with ISO. Information may be

obtained from the patent database available at www .iso .org/ patents.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights other than those in the patent database. ISO shall not be held responsible for identifying

any or all such patent rights.

INTERNATIONAL STANDARD ISO 10962:redline:2021(E)

Securities and related financial instruments —

Classification of financial instruments (CFI) code

1 Scope

This document defines and describes the structure for the codes for an internationally valid system

to classify financial instruments. The classification system applies to financial instruments negotiated

internationally as well as to domestic instruments. The term “financial instruments” refers not only to

classical securities, and derivatives but also covers the innovative financial products that have emerged

in different markets (a trend that is expected to continue in the future).

This document is intended for use in any application in the trading and administration of

securitiesfinancial instruments in the international securities business. In so farInsofar as the trading