ISO 9564-1:2017

(Main)Financial services — Personal Identification Number (PIN) management and security — Part 1: Basic principles and requirements for PINs in card-based systems

Financial services — Personal Identification Number (PIN) management and security — Part 1: Basic principles and requirements for PINs in card-based systems

ISO 9564-1:2017 specifies the basic principles and techniques which provide the minimum security measures required for effective international PIN management. These measures are applicable to those institutions responsible for implementing techniques for the management and protection of PINs during their creation, issuance, usage and deactivation. ISO 9564-1:2017 is applicable to the management of cardholder PINs for use as a means of cardholder verification in retail banking systems in, notably, automated teller machine (ATM) systems, point-of-sale (POS) terminals, automated fuel dispensers, vending machines, banking kiosks and PIN selection/change systems. It is applicable to issuer and interchange environments. The provisions of ISO 9564-1:2017 are not intended to cover: a) PIN management and security in environments where no persistent cryptographic relationship exists between the transaction-origination device and the acquirer, e.g. use of a browser for online shopping (for these environments, see ISO 9564-4); b) protection of the PIN against loss or intentional misuse by the customer; c) privacy of non-PIN transaction data; d) protection of transaction messages against alteration or substitution; e) protection against replay of the PIN or transaction; f) specific key management techniques; g) offline PIN verification used in contactless devices; h) requirements specifically associated with PIN management as it relates to multi-application functionality in an ICC.

Services financiers — Gestion et sécurité du numéro personnel d'identification (PIN) — Partie 1: Principes de base et exigences relatifs aux PINs dans les systèmes à carte

General Information

- Status

- Published

- Publication Date

- 01-Nov-2017

- Technical Committee

- ISO/TC 68/SC 2 - Financial Services, security

- Drafting Committee

- ISO/TC 68/SC 2/WG 13 - Security in retail banking

- Current Stage

- 9092 - International Standard to be revised

- Start Date

- 05-Nov-2024

- Completion Date

- 14-Feb-2026

Relations

- Effective Date

- 05-Nov-2015

- Effective Date

- 05-Nov-2015

Overview

ISO 9564-1:2017 - Financial services - Personal Identification Number (PIN) management and security - Part 1 defines the basic principles and minimum security requirements for effective PIN management in card-based systems. The standard covers the PIN life cycle (creation, issuance, activation, entry, transmission, verification, storage, deactivation and disposal) and applies to issuers and interchange environments that support cardholder verification in retail banking channels such as ATMs, POS terminals, fuel dispensers, vending machines, banking kiosks and PIN selection/change systems.

Key topics and technical requirements

- PIN lifecycle protections: Guidance for secure establishment, issuance, activation, change, replacement, deactivation and destruction of PINs to minimize fraud risk.

- PIN handling devices: Security requirements and physical protection for PIN entry devices (PEDs) and integrated circuit (IC) readers, including device characteristics and keypad considerations.

- PIN entry and transmission: Controls for secure PIN entry and for protecting the PIN during transmission to the issuer or to an ICC for offline verification.

- PIN encipherment and PIN blocks: Use of protected PIN block formats (compact and extended formats, including Formats 0–4) and constraints on PIN block translation and journalizing.

- PIN verification modes: Differences between online PIN verification (host-based) and offline PIN verification (card/ICC-based) and related protection measures.

- Operational controls: Recording media handling, oral and telephone PIN controls, storage, mailer handling and secure disposal of sensitive material.

- Scope exclusions: The standard explicitly does not cover browser-based environments without persistent cryptographic relationships (see ISO 9564-4), customer misuse, privacy of non-PIN data, message integrity or replay protection, specific key-management techniques, offline PIN in contactless devices or multi-application ICC specifics.

Practical applications - who uses ISO 9564-1:2017

- Card issuers and payment processors implementing PIN issuance and verification systems

- Acquirers, interchange operators and banks managing PIN flows across networks

- ATM and POS manufacturers, PED vendors and IC reader designers

- Security architects, compliance officers and auditors responsible for retail payment security and fraud mitigation

- Service providers operating PIN selection/change systems, mailer production and secure PIN delivery

Related standards

- ISO 9564-2 (approved encipherment algorithms for PIN protection)

- ISO 9564-4 (PIN security in environments without persistent cryptographic relationships)

- Other retail banking security standards: ISO 11568, ISO 13491 and ISO 16609

By following ISO 9564-1:2017, organizations can align PIN management and PIN security practices with internationally recognized requirements for card-based payment systems, reducing operational risk and fraud exposure.

Buy Documents

ISO 9564-1:2017 - Financial services -- Personal Identification Number (PIN) management and security

ISO 9564-1:2017 - Financial services — Personal Identification Number (PIN) management and security — Part 1: Basic principles and requirements for PINs in card-based systems Released:11/2/2017

Get Certified

Connect with accredited certification bodies for this standard

BSI Group

BSI (British Standards Institution) is the business standards company that helps organizations make excellence a habit.

NYCE

Mexican standards and certification body.

Sponsored listings

Frequently Asked Questions

ISO 9564-1:2017 is a standard published by the International Organization for Standardization (ISO). Its full title is "Financial services — Personal Identification Number (PIN) management and security — Part 1: Basic principles and requirements for PINs in card-based systems". This standard covers: ISO 9564-1:2017 specifies the basic principles and techniques which provide the minimum security measures required for effective international PIN management. These measures are applicable to those institutions responsible for implementing techniques for the management and protection of PINs during their creation, issuance, usage and deactivation. ISO 9564-1:2017 is applicable to the management of cardholder PINs for use as a means of cardholder verification in retail banking systems in, notably, automated teller machine (ATM) systems, point-of-sale (POS) terminals, automated fuel dispensers, vending machines, banking kiosks and PIN selection/change systems. It is applicable to issuer and interchange environments. The provisions of ISO 9564-1:2017 are not intended to cover: a) PIN management and security in environments where no persistent cryptographic relationship exists between the transaction-origination device and the acquirer, e.g. use of a browser for online shopping (for these environments, see ISO 9564-4); b) protection of the PIN against loss or intentional misuse by the customer; c) privacy of non-PIN transaction data; d) protection of transaction messages against alteration or substitution; e) protection against replay of the PIN or transaction; f) specific key management techniques; g) offline PIN verification used in contactless devices; h) requirements specifically associated with PIN management as it relates to multi-application functionality in an ICC.

ISO 9564-1:2017 specifies the basic principles and techniques which provide the minimum security measures required for effective international PIN management. These measures are applicable to those institutions responsible for implementing techniques for the management and protection of PINs during their creation, issuance, usage and deactivation. ISO 9564-1:2017 is applicable to the management of cardholder PINs for use as a means of cardholder verification in retail banking systems in, notably, automated teller machine (ATM) systems, point-of-sale (POS) terminals, automated fuel dispensers, vending machines, banking kiosks and PIN selection/change systems. It is applicable to issuer and interchange environments. The provisions of ISO 9564-1:2017 are not intended to cover: a) PIN management and security in environments where no persistent cryptographic relationship exists between the transaction-origination device and the acquirer, e.g. use of a browser for online shopping (for these environments, see ISO 9564-4); b) protection of the PIN against loss or intentional misuse by the customer; c) privacy of non-PIN transaction data; d) protection of transaction messages against alteration or substitution; e) protection against replay of the PIN or transaction; f) specific key management techniques; g) offline PIN verification used in contactless devices; h) requirements specifically associated with PIN management as it relates to multi-application functionality in an ICC.

ISO 9564-1:2017 is classified under the following ICS (International Classification for Standards) categories: 35.240.40 - IT applications in banking. The ICS classification helps identify the subject area and facilitates finding related standards.

ISO 9564-1:2017 has the following relationships with other standards: It is inter standard links to ISO 9564-1:2011, ISO 9564-1:2011/Amd 1:2015. Understanding these relationships helps ensure you are using the most current and applicable version of the standard.

ISO 9564-1:2017 is available in PDF format for immediate download after purchase. The document can be added to your cart and obtained through the secure checkout process. Digital delivery ensures instant access to the complete standard document.

Standards Content (Sample)

INTERNATIONAL ISO

STANDARD 9564-1

Fourth edition

2017-11

Financial services — Personal

Identification Number (PIN)

management and security —

Part 1:

Basic principles and requirements for

PINs in card-based systems

Services financiers — Gestion et sécurité du numéro personnel

d'identification (PIN) —

Partie 1: Principes de base et exigences relatifs aux PINs dans les

systèmes à carte

Reference number

©

ISO 2017

© ISO 2017, Published in Switzerland

All rights reserved. Unless otherwise specified, no part of this publication may be reproduced or utilized otherwise in any form

or by any means, electronic or mechanical, including photocopying, or posting on the internet or an intranet, without prior

written permission. Permission can be requested from either ISO at the address below or ISO’s member body in the country of

the requester.

ISO copyright office

Ch. de Blandonnet 8 • CP 401

CH-1214 Vernier, Geneva, Switzerland

Tel. +41 22 749 01 11

Fax +41 22 749 09 47

copyright@iso.org

www.iso.org

ii © ISO 2017 – All rights reserved

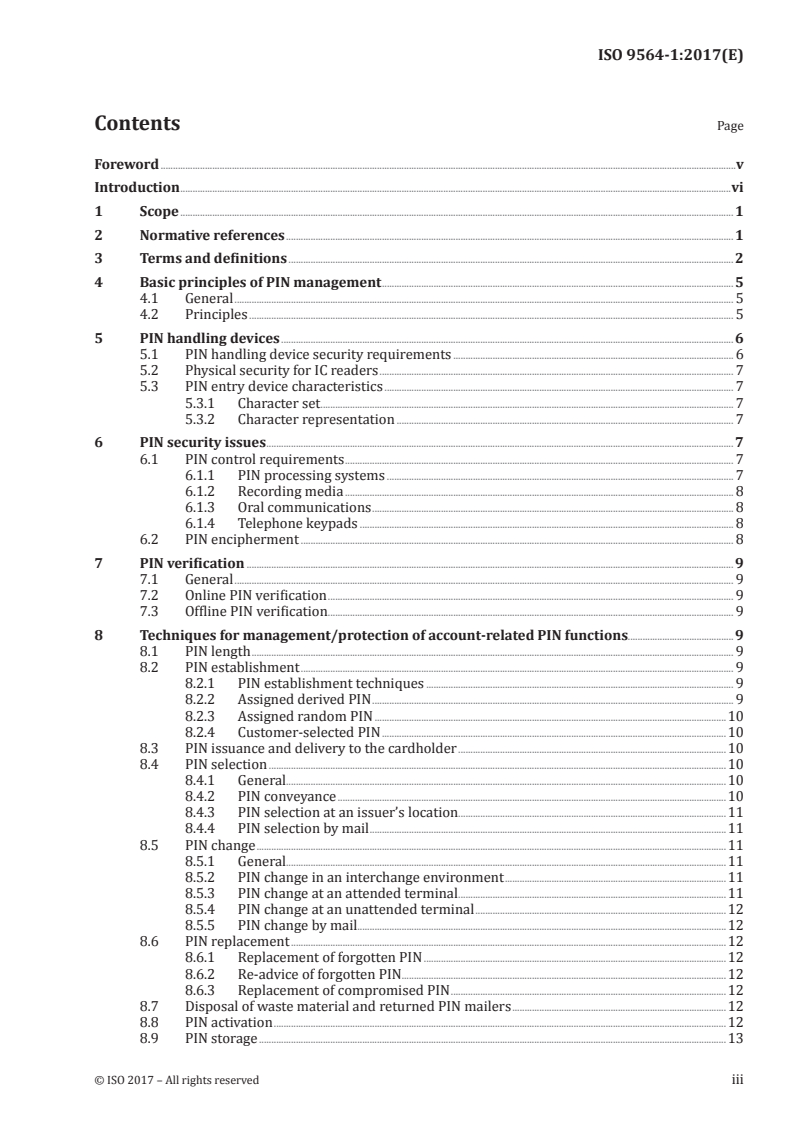

Contents Page

Foreword .v

Introduction .vi

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 2

4 Basic principles of PIN management . 5

4.1 General . 5

4.2 Principles . 5

5 PIN handling devices . 6

5.1 PIN handling device security requirements . 6

5.2 Physical security for IC readers . 7

5.3 PIN entry device characteristics . 7

5.3.1 Character set . 7

5.3.2 Character representation . 7

6 PIN security issues . 7

6.1 PIN control requirements . 7

6.1.1 PIN processing systems . 7

6.1.2 Recording media . 8

6.1.3 Oral communications . 8

6.1.4 Telephone keypads . 8

6.2 PIN encipherment . 8

7 PIN verification . 9

7.1 General . 9

7.2 Online PIN verification . 9

7.3 Offline PIN verification . 9

8 Techniques for management/protection of account-related PIN functions.9

8.1 PIN length . 9

8.2 PIN establishment . 9

8.2.1 PIN establishment techniques . 9

8.2.2 Assigned derived PIN . 9

8.2.3 Assigned random PIN .10

8.2.4 Customer-selected PIN .10

8.3 PIN issuance and delivery to the cardholder .10

8.4 PIN selection .10

8.4.1 General.10

8.4.2 PIN conveyance .10

8.4.3 PIN selection at an issuer’s location.11

8.4.4 PIN selection by mail .11

8.5 PIN change .11

8.5.1 General.11

8.5.2 PIN change in an interchange environment .11

8.5.3 PIN change at an attended terminal .11

8.5.4 PIN change at an unattended terminal .12

8.5.5 PIN change by mail . . .12

8.6 PIN replacement .12

8.6.1 Replacement of forgotten PIN .12

8.6.2 Re-advice of forgotten PIN.12

8.6.3 Replacement of compromised PIN .12

8.7 Disposal of waste material and returned PIN mailers .12

8.8 PIN activation .12

8.9 PIN storage .13

8.10 PIN deactivation .13

8.11 PIN mailers .13

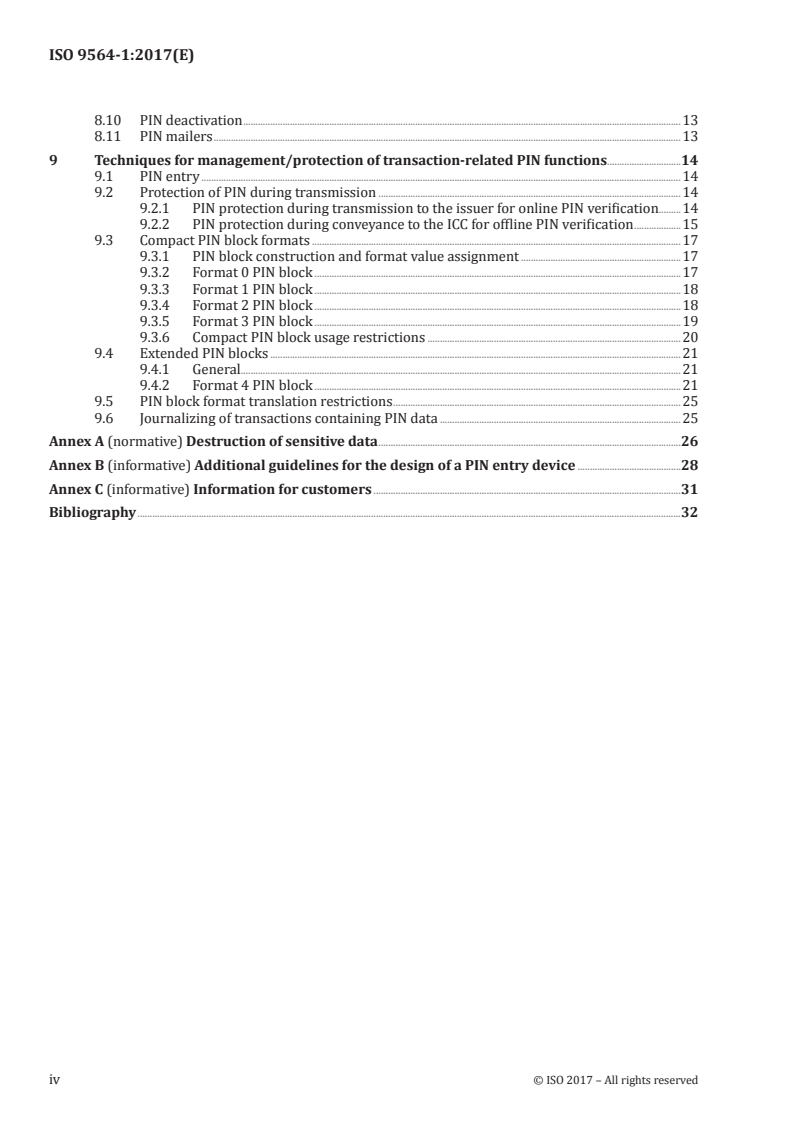

9 Techniques for management/protection of transaction-related PIN functions .14

9.1 PIN entry .14

9.2 Protection of PIN during transmission .14

9.2.1 PIN protection during transmission to the issuer for online PIN verification.14

9.2.2 PIN protection during conveyance to the ICC for offline PIN verification .15

9.3 Compact PIN block formats .17

9.3.1 PIN block construction and format value assignment .17

9.3.2 Format 0 PIN block .17

9.3.3 Format 1 PIN block .18

9.3.4 Format 2 PIN block .18

9.3.5 Format 3 PIN block .19

9.3.6 Compact PIN block usage restrictions .20

9.4 Extended PIN blocks .21

9.4.1 General.21

9.4.2 Format 4 PIN block .21

9.5 PIN block format translation restrictions .25

9.6 Journalizing of transactions containing PIN data .25

Annex A (normative) Destruction of sensitive data .26

Annex B (informative) Additional guidelines for the design of a PIN entry device .28

Annex C (informative) Information for customers .31

Bibliography .32

iv © ISO 2017 – All rights reserved

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www.iso.org/directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www.iso.org/patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation on the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT) see the following

URL: www.iso.org/iso/foreword.html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 2,

Financial Services, security.

This fourth edition cancels and replaces the third edition (ISO 9564-1:2011), which has been technically

revised.

It also incorporates the Amendment ISO 9564-1:2011/Amd 1:2015.

A list of all parts in the ISO 9564 series can be found on the ISO website.

Introduction

A Personal Identification Number (PIN) is used in financial services as one method of cardholder

verification.

The objective of PIN management is to protect the PIN against unauthorized disclosure, compromise

and misuse throughout its life cycle and, in so doing, to minimize the risk of fraud occurring within

electronic funds transfer (EFT) systems. The secrecy of the PIN needs to be ensured at all times during

its life cycle, which consists of its establishment, issuance, activation, storage, entry, transmission,

validation, deactivation and any other use made of it.

In this document, the following terms are used for the types of communication of the PIN.

a) Conveyance: reference PIN to the integrated circuit (IC) card or cardholder selected PIN to the issuer.

b) Delivery: PIN to the cardholder.

c) Transmission: transaction PIN to the issuer or IC reader for subsequent PIN verification.

d) Submission: transaction PIN to the ICC.

PIN security in part depends upon sound key management. Maintaining the secrecy of cryptographic

keys is of the utmost importance because the compromise of any key allows the compromise of any PIN

ever enciphered under it.

PINs can be verified online or offline. Since online PIN verification can be performed independent of the

card itself, any type of payment card or device can be used to initiate such a transaction. However, there

are special card requirements for those cards that perform offline PIN verification on the card itself.

Financial transaction cards with embedded IC can support offline PIN verification using the IC of

the card. Issuers can choose whether to have PIN verification performed online or offline. Offline

PIN verification does not require that a cardholder's PIN be sent to the issuer host for verification

and so security requirements relating to PIN protection differ from online PIN verification security

requirements. However, many general PIN protection principles and techniques are still applicable

even though a PIN can be verified offline.

This document is designed so that issuers can achieve reasonable assurance that a PIN, while under the

control of other institutions, is properly managed. Techniques are given for protecting the PIN-based

customer authentication process by safeguarding the PIN against unauthorized disclosure during the

PIN’s life cycle.

In ISO 9564-2, approved encipherment algorithms for use in the protection of the PIN are specified.

ISO 9564 is one of several series of International Standards which describe requirements for security in

the retail banking environment; these include ISO 11568 (all parts), ISO 13491 (all parts) and ISO 16609.

vi © ISO 2017 – All rights reserved

INTERNATIONAL STANDARD ISO 9564-1:2017(E)

Financial services — Personal Identification Number (PIN)

management and security —

Part 1:

Basic principles and requirements for PINs in card-

based systems

1 Scope

This document specifies the basic principles and techniques which provide the minimum security

measures required for effective international PIN management. These measures are applicable to

those institutions responsible for implementing techniques for the management and protection of PINs

during their creation, issuance, usage and deactivation.

This document is applicable to the management of cardholder PINs for use as a means of cardholder

verification in retail banking systems in, notably, automated teller machine (ATM) systems, point-

of-sale (POS) terminals, automated fuel dispensers, vending machines, banking kiosks and PIN

selection/change systems. It is applicable to issuer and interchange environments.

The provisions of this document are not intended to cover:

a) PIN management and security in environments where no persistent cryptographic relationship

exists between the transaction-origination device and the acquirer, e.g. use of a browser for online

shopping (for these environments, see ISO 9564-4);

b) protection of the PIN against loss or intentional misuse by the customer;

c) privacy of non-PIN transaction data;

d) protection of transaction messages against alteration or substitution;

e) protection against replay of the PIN or transaction;

f) specific key management techniques;

g) offline PIN verification used in contactless devices;

h) requirements specifically associated with PIN management as it relates to multi-application

functionality in an ICC.

2 Normative references

The following documents are referred to in the text in such a way that some or all of their content

constitutes requirements of this document. For dated references, only the edition cited applies. For

undated references, the latest edition of the referenced document (including any amendments) applies.

ISO/IEC 7816 (all parts), Identification cards — Integrated circuit cards

ISO 9564-2, Financial services — Personal Identification Number (PIN) management and security —

Part 2: Approved algorithms for PIN encipherment

ISO 11568 (all parts), Banking — Key management (retail)

ISO 13491-1, Financial services — Secure cryptographic devices (retail) — Part 1: Concepts, requirements

and evaluation methods

ISO 13491-2:2017, Financial services — Secure cryptographic devices (retail) — Part 2: Security compliance

checklists for devices used in financial transactions

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

— ISO Online browsing platform: available at http://www.iso.org/obp

— IEC Electropedia: available at http://www.electropedia.org/

3.1

acquirer

institution (or its agent) that acquires from the card acceptor (3.3) the financial data relating to the

transaction and initiates such data into an interchange system

3.2

algorithm

clearly specified mathematical process for computation

3.3

card acceptor

party accepting the card and presenting transaction data to an acquirer (3.1)

3.4

cardholder PIN

PIN (3.19) known by the cardholder (3.8)

3.5

cipher text

data in their enciphered form

3.6

compromise

breaching of confidentiality and/or integrity

3.7

cryptographic key

mathematical value that is used in an algorithm (3.2) to transform plain text (3.21) into cipher text (3.5)

or vice versa

3.8

customer

cardholder

individual associated with the primary account number (PAN) (3.22) specified in the transaction

3.9

decipherment

reversal of a previous reversible encipherment (3.26) rendering cipher text (3.5) into plain text (3.21)

3.10

dual control

process of utilizing two or more separate entities (usually persons) operating in concert to protect

sensitive functions or information whereby no single entity is able to access or utilize the materials

EXAMPLE A cryptographic key (3.7) is an example of the type of material protected by dual control.

2 © ISO 2017 – All rights reserved

3.11

encipherment

rendering of text unintelligible by means of an encoding mechanism

3.12

integrated circuit

IC

microprocessor (typically) embedded in an ICC (3.13)as specified in ISO/IEC 7816 (all parts)

3.13

integrated circuit card

ICC

card with integrated circuits as specified in ISO/IEC 7816 (all parts)

Note 1 to entry: All references to an ICC are understood to be references to the IC (3.12) of the card and not to any

other storage on the card (e.g. magnetic stripe).

3.14

irreversible encipherment

transformation of plain text (3.21) to cipher text (3.5) in such a way that the original plain text cannot be

recovered other than by exhaustive procedures, even if the cryptographic key (3.7) is known

3.15

issuer

institution holding the account identified by the primary account number (PAN) (3.22)

3.16

key component

one of at least two parameters having the format of a cryptographic key (3.7) that is added modulo-2

with one or more like parameters to form a cryptographic key

3.17

modulo-2 addition

exclusive OR-ing

binary addition with no carry

3.18

node

message processing entity through which a transaction passes

3.19

Personal Identification Number

PIN

string of numeric digits established as a shared secret between the cardholder (3.8) and the issuer

(3.15), for subsequent use to validate authorized card usage

3.20

PIN entry device

PED

device providing for the secure entry of PINs (3.19)

Note 1 to entry: Security requirements for PIN entry devices are specified in 5.1.

3.21

plain text

data in its original unenciphered form

3.22

primary account number

PAN

assigned number, composed of an issuer identification number, an individual account identification

and an accompanying check digit as specified in ISO/IEC 7812-1, which identifies the card issuer and

cardholder (3.8)

3.23

primary account number token

PAN Token

surrogate value used in place of the original PAN (3.22) in certain, well-defined situations, but that is

not used in place of the original PAN in every way that the original PAN is used

3.24

pseudo-random number

number that is statistically random and essentially unpredictable although generated by an

algorithmic process

3.25

reference PIN

value of the PIN (3.19) used to verify the transaction PIN (3.30)

3.26

reversible encipherment

transformation of plain text (3.21) to cipher text (3.5) in such a way that the original plain text can be

recovered

3.27

sensitive state

device condition that provides access to the secure operator interface such that it can only be entered

when the device is under dual or multiple control

3.28

split knowledge

condition under which two or more parties separately and confidentially have custody of components

of a single key that individually convey no knowledge of the resultant cryptographic key (3.7)

3.29

terminal

acquirer-sponsored device that accepts ISO/IEC 7813 and ISO/IEC 7816 compliant cards and initiates

transactions into a payments system

Note 1 to entry: It can also include other components and interfaces, such as host communications.

3.30

transaction PIN

PIN (3.19) as entered by the customer (3.8) at the time of the transaction and subsequently transmitted

to an issuer system or submitted to the ICC (3.13) for verification

Note 1 to entry: Verification means comparison to the reference PIN (3.25).

3.31

true random number generator

device that utilizes an unpredictable and non-deterministic physical phenomenon to produce a stream

of bits, where the ability to predict any bit is no greater than 0,5 given knowledge of all preceding and

following bits

4 © ISO 2017 – All rights reserved

4 Basic principles of PIN management

4.1 General

The term “PIN” is used to describe any string of numeric digits established as a shared secret between

the cardholder and the issuer, for subsequent use to validate authorized card usage. The term PIN may

be qualified as “cardholder PIN”, “reference PIN” and “transaction PIN” in the following ways.

a) Issuance:

1) the PIN

i) is generated by the issuer and delivered to the cardholder (as the cardholder PIN), or

ii) is selected by the cardholder and conveyed to the issuer;

2) the issuer stores the PIN as the reference PIN or stores data such that the reference PIN can be

recalculated; the reference PIN may be stored in the issuer system and/or an ICC.

b) Usage:

1) the cardholder enters their PIN into a PED. The PIN, once entered into a PED, is the

transaction PIN;

2) the transaction PIN is transmitted to the issuer or sent to the ICC for comparison with the

reference PIN.

Some requirements pertain to all PINs while other requirements are specific to cardholder PINs,

reference PINs, and/or transaction PINs. Where requirements apply to all PINs, the term PIN is used

without qualification.

4.2 Principles

PIN management shall be governed by the following basic principles.

a) Fraudulent modification or access to the hardware and software used for all PIN management

functions shall be prevented or detected (see 6.1.1).

b) For different accounts, encipherment of the same PIN value under a given encipherment key shall

not produce the same cipher text (see 6.2) except by chance.

c) Security of an enciphered PIN shall not rely on the secrecy of the encipherment design or algorithm,

but on the security of the cryptographic key (see 6.2).

d) A PIN shall not exist outside of a secure cryptographic device (SCD), as defined in 5.1, except in the

following cases:

1) delivery of the PIN to the cardholder using an approved method as defined in 8.3;

2) enciphered using an approved algorithm, as defined in 6.2, in a process that ensures two

accounts with the same PIN do not have the same encrypted value; this process may use PIN

block formats 0 or 3;

3) conveyance of the reference PIN to the ICC to enable offline PIN verification, as defined in 8.9;

4) storage of a reference PIN within an ICC in accordance with 7.3;

5) submission of a transaction PIN to an ICC in accordance with 9.2.2.

e) PIN issuance shall be performed only by personnel authorized by the issuer as defined in 8.3.

f) PIN selection/change shall be performed only by the cardholder as defined in 8.2.4 and 8.5.

g) Management of PIN establishment/change devices shall be performed only by personnel authorized

by the issuer, except as allowed in 8.5. Such personnel shall operate only under strictly enforced

procedures.

h) With the exception of PIN selection/change by mail (see 8.4.4 and 8.5.5), the PIN shall never be

known to, or accessible by, any employee or agent of the institution, not even in the PIN issuing

process.

i) A stored reference PIN shall be protected from unauthorized substitution as defined in 8.9.

j) Compromise of the PIN (or suspected compromise) shall result in the ending of the PIN life cycle as

defined in 8.10.

k) Responsibility for PIN verification shall rest with the issuer as defined in 7.2 and 7.3.

l) Different encipherment keys shall be used to protect the reference PIN and the transaction PIN as

defined in 6.2.

m) The customer shall be advised in writing of the importance of the PIN and PIN secrecy (see Annex C

for guidance).

n) Clear text and/or enciphered transaction PINs shall never be retained. Transaction PINs shall only

exist for the duration of a single transaction (the time between PIN entry and verification, i.e. store

and forward).

o) Any part of a PIN (e.g. individual digit or representations thereof) shall be subject to the same

security requirements as the entire PIN as defined in this document.

For the purposes of this document, an ICC is considered to be part of the issuer’s domain.

5 PIN handling devices

5.1 PIN handling device security requirements

A PIN handling device is a device that handles clear text PINs, e.g. PIN entry device, IC reader and

host security module (HSM), etc. Any additional functionality provided by the device or the system

into which it is integrated shall not impair the security of the device or the PIN entry process. A PIN

handling device, other than an ICC, shall be an SCD meeting the requirements of ISO 13491-1. The

security requirements for an ICC are specified in 7.3.

A PIN entry device shall not rely on tamper evidence as its sole physical security characteristic.

The PIN entry device shall include tamper-detection and response mechanisms which, if attacked,

cause the PED to become immediately inoperable and result in the automatic and immediate erasure of

any secret information that might be stored in the PED, such that it becomes infeasible to recover the

secret information.

The PIN entry device should be able to authenticate itself to the acquirer such that, once compromised,

it is no longer able to authenticate itself to the acquirer. An example method to support this requirement

is where Message Authentication Codes (MAC) are calculated over online transaction messages and the

MAC key is erased if the PIN entry device is attacked.

NOTE Systems supporting online PIN verification typically meet this requirement in that the acquirer

authenticates the validity of the PIN entry device each time a PIN is processed. (The authentication of the PIN

entry device is implicit in the usage of the PIN encryption key.)

The display used to prompt a cardholder to enter their PIN shall be controlled such that modification

and/or improper use of the prompts is not feasible (see ISO 13491-2:2017, Table B.1 number B2 and

Table B.3 number B22).

6 © ISO 2017 – All rights reserved

The card reader shall be protected to prevent unauthorized access, substitution or alteration of the

card data read from the card (see ISO 13491-2:2017, Table B.1 number B3 and Table B.3 number B28).

5.2 Physical security for IC readers

The following requirements are specific to IC readers. The slot of the IC reader into which the ICC is

inserted should

a) not have sufficient space to hold a PIN-disclosing “bug” when a card is in the IC reader,

b) nor be enlarged to provide space for a PIN-disclosing “bug” without detection,

c) nor be positioned such that wires leaving the slot to an external “bug” can be hidden from users of

the device.

5.3 PIN entry device characteristics

5.3.1 Character set

All PIN entry devices shall provide for the entry of the decimal numeric characters zero to nine.

NOTE It is recognized that alphabetic characters, although not addressed in this document, can be used as

synonyms for decimal numeric characters. Further guidance on the design of PIN entry devices, including alpha

to numeric mappings, is given in Annex B.

5.3.2 Character representation

The relationship between the numeric value of a PIN character and the internal coding of that value

prior to any encipherment shall be as specified in Table 1.

Table 1 — Character representation

PIN character Internal binary

0 0000

1 0001

2 0010

3 0011

4 0100

5 0101

6 0110

7 0111

8 1000

9 1001

6 PIN security issues

6.1 PIN control requirements

6.1.1 PIN processing systems

PIN processing systems are systems that process PINs in all stages of the PIN life cycle, e.g. merchant

terminal systems, host application software driving host security modules, and card and PIN

personalization systems, etc.

Systems used in PIN processing shall be implemented in such a way that the following are ensured.

a) The hardware and software are correctly performing their designed function and only their

designed function.

b) The hardware and software cannot be modified or accessed without detection and/or disabling.

c) Information cannot be fraudulently accessed or modified without detection and rejection of the

attempt.

d) The system is not capable of being used or misused to determine a PIN by exhaustive trial and error.

e) Any PIN management device (e.g. host security modules) handling clear text PINs conforms to the

requirements of secure cryptographic devices with PIN management functionality as specified in

ISO 13491-2.

f) Output of any sensitive information used in the selection, calculation or encipherment of the PIN is

controlled during use, delivery, conveyance, submission, transmission, storage and disposal.

g) Except when the PIN is to be sent to the ICC in clear text, the PIN is enciphered immediately upon

entry into the PED.

6.1.2 Recording media

Any recording media containing data from which a plain text PIN might be determined shall be rendered

unreadable or physically destroyed immediately after use in accordance with Annex A.

6.1.3 Oral communications

No procedure shall require or permit oral communication of the plain text PIN, either in person or by a

person over the telephone.

An institution shall never permit its employees to ask a customer to disclose the PIN or to recommend

specific values.

6.1.4 Telephone keypads

Procedures of an institution shall not permit entry of the plain text PIN through a keypad of a telephone

at any time in the PIN life cycle, unless the telephone device is designed and constructed to meet the

requirements specified in 5.1 for PIN entry devices and 9.2 for PIN transmission.

6.2 PIN encipherment

If it is necessary to encipher a PIN (see 9.2), this shall be accomplished using one of the approved

algorithms specified in ISO 9564-2.

Different encipherment keys shall be used to protect the reference PIN and the transaction PIN.

Symmetric PIN encipherment keys may be used in online and offline PIN verification systems.

Symmetric PIN encipherment keys shall not be used for any other cryptographic purpose.

Asymmetric PIN encipherment is only permitted in offline PIN verification systems. Asymmetric PIN

encipherment keys should not be used for any other cryptographic purpose.

The adopted encipherment procedure shall ensure that the encipherment of a plain text PIN value using

a particular cryptographic key does not predictably produce the same enciphered value when the same

PIN value is associated with different accounts.

NOTE A format 2 PIN block does not meet this requirement without additional protection mechanisms.

8 © ISO 2017 – All rights reserved

Key management practices associated with PIN encipherment shall comply with the requirements of

ISO 11568 (all parts).

7 PIN verification

7.1 General

PIN verification is the process whereby a transaction PIN is compared with a reference PIN to determine

whether the two have the same value. Derivatives of the transaction and reference PINs may be used

during the PIN verification process in lieu of the clear text PIN.

7.2 Online PIN verification

Transaction PINs are verified online after secure transmission to the issuer according to 9.2.1.

Responsibility for online PIN verification shall rest with the issuer.

7.3 Offline PIN verification

Transaction PINs are verified offline after submission to the ICC according to 9.2.2. Responsibility for

offline PIN verification shall rest with the issuer through programming/configuration of the ICC which

is under issuer control.

An ICC containing a reference PIN for offline PIN verification shall provide a level of protection against

known attacks on the ICC sufficient to prevent recovery of the plain text reference or transaction PIN or

any other secrets stored within the ICC.

8 Techniques for management/protection of account-related PIN functions

8.1 PIN length

A PIN shall be not less than four and not more than 12 digits in length.

While there is a security advantage to having a longer PIN, usefulness may be hindered. For usability

reasons, an assigned numeric PIN should not exceed six digits in length.

8.2 PIN establishment

8.2.1 PIN establishment techniques

A PIN shall be established using one of the following techniques:

a) assigned derived PIN;

b) assigned random PIN;

c) customer-selected PIN.

8.2.2 Assigned derived PIN

When the reference PIN is an “assigned derived PIN”, the issuer shall derive it cryptographically from

a) the primary account number, and/or

b) some other value associated with the customer.

The PIN derivation process should not contain a bias towards specific sets or values.

8.2.3 Assigned random PIN

When the reference PIN is an “assigned random PIN”, the issuer shall obtain a value by means of either

a) a true random number generator, or

b) a pseudo-random number generator.

These may be achieved using a random number generator compliant with ISO/IEC 18031 and tested

using NIST/SP 800-22.

8.2.4 Customer-selected PIN

When a reference PIN is a “customer-selected PIN”, the value shall be selected by the customer. In this

case, the issuer shall provide the customer with the necessary selection instructions and warnings (see

Annex C for guidance).

8.3 PIN issuance and delivery to the cardholder

Methods used for the issuance and delivery of the PIN to the cardholder shall comply with the following

basic requirements.

a) The plain text PIN shall never be transmitted over communications lines outside of a secure

environment as specified in ISO 13491-2:2017, H.5, unless there is no feasible way in which the PIN

could be related to the cardholder, the cardholder’s account or card.

b) The PIN shall never be known to, or accessible by, any employee or agent of the institution, not even

in the PIN issuing process.

c) All PIN issuance functions involving issuer personnel (including their agents) shall be under dual

control.

d) At no point in the delivery process shall the PIN appear in plain text where it can be associated with

a customer’s account, primary account number (PAN) or PAN Token.

e) The PIN shall never be retrieved and deciphered or regenerated for recording, processing,

displaying or printing, except for presentation to the cardholder in a manner that ensures the

secrecy of the PIN (e.g. a PIN mailer implemented in accordance with 8.11 or personal secure

cryptographic device with display capability).

f) Where it is necessary, for the purposes of preparing the PIN for delivery to the cardholder, for the

PIN to exist as plain text outside of a secure cryptographic device (e.g. PIN mailer printing), then

it shall exist in that condition for the minimum period of time necessary and it shall be contained

within a secure environment as specified in ISO 13491-2:2016, H.5.

8.4 PIN selection

8.4.1 General

PIN selection is a process performed by the cardholder either as part of the card issuance process or

during PIN change.

8.4.2 PIN conveyance

A PIN selected by the customer shall be conveyed to the issuer using one of the following techniques:

a) PIN selection at an issuer’s location (see 8.4.3);

b) PIN selection by mail (see 8.4.4).

10 © ISO 2017 – All rights reserved

8.4.3 PIN selection at an issuer’s location

PIN selection shall be accomplished at an issuer’s location via a PIN entry device complying with the

requirements of 5.1. Selection and entry of the PIN shall not involve the customer disclosing the PIN to

any issuer’s employee or third party. The following procedure shall be applied.

a) An authorized employee shall obtain proper identification of the customer.

b) The system shall require identification and authorization of the issuer’s employees.

c) The PIN selection process shall be enabled by an authorized employee. The process shall be

terminated by the completion of a PIN selection.

d) The authorized employee’s identification, together with the date and the time, shall become a part

of the transaction record.

e) The entry of the PIN shall be validated by requiring it to be entered twice and verifying that both

entries are identical. The comparison of the two PIN entries shall be performed in a manner such

that no PIN information is exposed.

8.4.4 PIN selection by mail

PIN selection by mail shall only be accomplished by the use of a form containing a control number and

space for a selected PIN.

...

INTERNATIONAL ISO

STANDARD 9564-1

Fourth edition

2017-11

Financial services — Personal

Identification Number (PIN)

management and security —

Part 1:

Basic principles and requirements for

PINs in card-based systems

Services financiers — Gestion et sécurité du numéro personnel

d'identification (PIN) —

Partie 1: Principes de base et exigences relatifs aux PINs dans les

systèmes à carte

Reference number

©

ISO 2017

© ISO 2017, Published in Switzerland

All rights reserved. Unless otherwise specified, no part of this publication may be reproduced or utilized otherwise in any form

or by any means, electronic or mechanical, including photocopying, or posting on the internet or an intranet, without prior

written permission. Permission can be requested from either ISO at the address below or ISO’s member body in the country of

the requester.

ISO copyright office

Ch. de Blandonnet 8 • CP 401

CH-1214 Vernier, Geneva, Switzerland

Tel. +41 22 749 01 11

Fax +41 22 749 09 47

copyright@iso.org

www.iso.org

ii © ISO 2017 – All rights reserved

Contents Page

Foreword .v

Introduction .vi

1 Scope . 1

2 Normative references . 1

3 Terms and definitions . 2

4 Basic principles of PIN management . 5

4.1 General . 5

4.2 Principles . 5

5 PIN handling devices . 6

5.1 PIN handling device security requirements . 6

5.2 Physical security for IC readers . 7

5.3 PIN entry device characteristics . 7

5.3.1 Character set . 7

5.3.2 Character representation . 7

6 PIN security issues . 7

6.1 PIN control requirements . 7

6.1.1 PIN processing systems . 7

6.1.2 Recording media . 8

6.1.3 Oral communications . 8

6.1.4 Telephone keypads . 8

6.2 PIN encipherment . 8

7 PIN verification . 9

7.1 General . 9

7.2 Online PIN verification . 9

7.3 Offline PIN verification . 9

8 Techniques for management/protection of account-related PIN functions.9

8.1 PIN length . 9

8.2 PIN establishment . 9

8.2.1 PIN establishment techniques . 9

8.2.2 Assigned derived PIN . 9

8.2.3 Assigned random PIN .10

8.2.4 Customer-selected PIN .10

8.3 PIN issuance and delivery to the cardholder .10

8.4 PIN selection .10

8.4.1 General.10

8.4.2 PIN conveyance .10

8.4.3 PIN selection at an issuer’s location.11

8.4.4 PIN selection by mail .11

8.5 PIN change .11

8.5.1 General.11

8.5.2 PIN change in an interchange environment .11

8.5.3 PIN change at an attended terminal .11

8.5.4 PIN change at an unattended terminal .12

8.5.5 PIN change by mail . . .12

8.6 PIN replacement .12

8.6.1 Replacement of forgotten PIN .12

8.6.2 Re-advice of forgotten PIN.12

8.6.3 Replacement of compromised PIN .12

8.7 Disposal of waste material and returned PIN mailers .12

8.8 PIN activation .12

8.9 PIN storage .13

8.10 PIN deactivation .13

8.11 PIN mailers .13

9 Techniques for management/protection of transaction-related PIN functions .14

9.1 PIN entry .14

9.2 Protection of PIN during transmission .14

9.2.1 PIN protection during transmission to the issuer for online PIN verification.14

9.2.2 PIN protection during conveyance to the ICC for offline PIN verification .15

9.3 Compact PIN block formats .17

9.3.1 PIN block construction and format value assignment .17

9.3.2 Format 0 PIN block .17

9.3.3 Format 1 PIN block .18

9.3.4 Format 2 PIN block .18

9.3.5 Format 3 PIN block .19

9.3.6 Compact PIN block usage restrictions .20

9.4 Extended PIN blocks .21

9.4.1 General.21

9.4.2 Format 4 PIN block .21

9.5 PIN block format translation restrictions .25

9.6 Journalizing of transactions containing PIN data .25

Annex A (normative) Destruction of sensitive data .26

Annex B (informative) Additional guidelines for the design of a PIN entry device .28

Annex C (informative) Information for customers .31

Bibliography .32

iv © ISO 2017 – All rights reserved

Foreword

ISO (the International Organization for Standardization) is a worldwide federation of national standards

bodies (ISO member bodies). The work of preparing International Standards is normally carried out

through ISO technical committees. Each member body interested in a subject for which a technical

committee has been established has the right to be represented on that committee. International

organizations, governmental and non-governmental, in liaison with ISO, also take part in the work.

ISO collaborates closely with the International Electrotechnical Commission (IEC) on all matters of

electrotechnical standardization.

The procedures used to develop this document and those intended for its further maintenance are

described in the ISO/IEC Directives, Part 1. In particular the different approval criteria needed for the

different types of ISO documents should be noted. This document was drafted in accordance with the

editorial rules of the ISO/IEC Directives, Part 2 (see www.iso.org/directives).

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. ISO shall not be held responsible for identifying any or all such patent rights. Details of

any patent rights identified during the development of the document will be in the Introduction and/or

on the ISO list of patent declarations received (see www.iso.org/patents).

Any trade name used in this document is information given for the convenience of users and does not

constitute an endorsement.

For an explanation on the voluntary nature of standards, the meaning of ISO specific terms and

expressions related to conformity assessment, as well as information about ISO's adherence to the

World Trade Organization (WTO) principles in the Technical Barriers to Trade (TBT) see the following

URL: www.iso.org/iso/foreword.html.

This document was prepared by Technical Committee ISO/TC 68, Financial services, Subcommittee SC 2,

Financial Services, security.

This fourth edition cancels and replaces the third edition (ISO 9564-1:2011), which has been technically

revised.

It also incorporates the Amendment ISO 9564-1:2011/Amd 1:2015.

A list of all parts in the ISO 9564 series can be found on the ISO website.

Introduction

A Personal Identification Number (PIN) is used in financial services as one method of cardholder

verification.

The objective of PIN management is to protect the PIN against unauthorized disclosure, compromise

and misuse throughout its life cycle and, in so doing, to minimize the risk of fraud occurring within

electronic funds transfer (EFT) systems. The secrecy of the PIN needs to be ensured at all times during

its life cycle, which consists of its establishment, issuance, activation, storage, entry, transmission,

validation, deactivation and any other use made of it.

In this document, the following terms are used for the types of communication of the PIN.

a) Conveyance: reference PIN to the integrated circuit (IC) card or cardholder selected PIN to the issuer.

b) Delivery: PIN to the cardholder.

c) Transmission: transaction PIN to the issuer or IC reader for subsequent PIN verification.

d) Submission: transaction PIN to the ICC.

PIN security in part depends upon sound key management. Maintaining the secrecy of cryptographic

keys is of the utmost importance because the compromise of any key allows the compromise of any PIN

ever enciphered under it.

PINs can be verified online or offline. Since online PIN verification can be performed independent of the

card itself, any type of payment card or device can be used to initiate such a transaction. However, there

are special card requirements for those cards that perform offline PIN verification on the card itself.

Financial transaction cards with embedded IC can support offline PIN verification using the IC of

the card. Issuers can choose whether to have PIN verification performed online or offline. Offline

PIN verification does not require that a cardholder's PIN be sent to the issuer host for verification

and so security requirements relating to PIN protection differ from online PIN verification security

requirements. However, many general PIN protection principles and techniques are still applicable

even though a PIN can be verified offline.

This document is designed so that issuers can achieve reasonable assurance that a PIN, while under the

control of other institutions, is properly managed. Techniques are given for protecting the PIN-based

customer authentication process by safeguarding the PIN against unauthorized disclosure during the

PIN’s life cycle.

In ISO 9564-2, approved encipherment algorithms for use in the protection of the PIN are specified.

ISO 9564 is one of several series of International Standards which describe requirements for security in

the retail banking environment; these include ISO 11568 (all parts), ISO 13491 (all parts) and ISO 16609.

vi © ISO 2017 – All rights reserved

INTERNATIONAL STANDARD ISO 9564-1:2017(E)

Financial services — Personal Identification Number (PIN)

management and security —

Part 1:

Basic principles and requirements for PINs in card-

based systems

1 Scope

This document specifies the basic principles and techniques which provide the minimum security

measures required for effective international PIN management. These measures are applicable to

those institutions responsible for implementing techniques for the management and protection of PINs

during their creation, issuance, usage and deactivation.

This document is applicable to the management of cardholder PINs for use as a means of cardholder

verification in retail banking systems in, notably, automated teller machine (ATM) systems, point-

of-sale (POS) terminals, automated fuel dispensers, vending machines, banking kiosks and PIN

selection/change systems. It is applicable to issuer and interchange environments.

The provisions of this document are not intended to cover:

a) PIN management and security in environments where no persistent cryptographic relationship

exists between the transaction-origination device and the acquirer, e.g. use of a browser for online

shopping (for these environments, see ISO 9564-4);

b) protection of the PIN against loss or intentional misuse by the customer;

c) privacy of non-PIN transaction data;

d) protection of transaction messages against alteration or substitution;

e) protection against replay of the PIN or transaction;

f) specific key management techniques;

g) offline PIN verification used in contactless devices;

h) requirements specifically associated with PIN management as it relates to multi-application

functionality in an ICC.

2 Normative references

The following documents are referred to in the text in such a way that some or all of their content

constitutes requirements of this document. For dated references, only the edition cited applies. For

undated references, the latest edition of the referenced document (including any amendments) applies.

ISO/IEC 7816 (all parts), Identification cards — Integrated circuit cards

ISO 9564-2, Financial services — Personal Identification Number (PIN) management and security —

Part 2: Approved algorithms for PIN encipherment

ISO 11568 (all parts), Banking — Key management (retail)

ISO 13491-1, Financial services — Secure cryptographic devices (retail) — Part 1: Concepts, requirements

and evaluation methods

ISO 13491-2:2017, Financial services — Secure cryptographic devices (retail) — Part 2: Security compliance

checklists for devices used in financial transactions

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

— ISO Online browsing platform: available at http://www.iso.org/obp

— IEC Electropedia: available at http://www.electropedia.org/

3.1

acquirer

institution (or its agent) that acquires from the card acceptor (3.3) the financial data relating to the

transaction and initiates such data into an interchange system

3.2

algorithm

clearly specified mathematical process for computation

3.3

card acceptor

party accepting the card and presenting transaction data to an acquirer (3.1)

3.4

cardholder PIN

PIN (3.19) known by the cardholder (3.8)

3.5

cipher text

data in their enciphered form

3.6

compromise

breaching of confidentiality and/or integrity

3.7

cryptographic key

mathematical value that is used in an algorithm (3.2) to transform plain text (3.21) into cipher text (3.5)

or vice versa

3.8

customer

cardholder

individual associated with the primary account number (PAN) (3.22) specified in the transaction

3.9

decipherment

reversal of a previous reversible encipherment (3.26) rendering cipher text (3.5) into plain text (3.21)

3.10

dual control

process of utilizing two or more separate entities (usually persons) operating in concert to protect

sensitive functions or information whereby no single entity is able to access or utilize the materials

EXAMPLE A cryptographic key (3.7) is an example of the type of material protected by dual control.

2 © ISO 2017 – All rights reserved

3.11

encipherment

rendering of text unintelligible by means of an encoding mechanism

3.12

integrated circuit

IC

microprocessor (typically) embedded in an ICC (3.13)as specified in ISO/IEC 7816 (all parts)

3.13

integrated circuit card

ICC

card with integrated circuits as specified in ISO/IEC 7816 (all parts)

Note 1 to entry: All references to an ICC are understood to be references to the IC (3.12) of the card and not to any

other storage on the card (e.g. magnetic stripe).

3.14

irreversible encipherment

transformation of plain text (3.21) to cipher text (3.5) in such a way that the original plain text cannot be

recovered other than by exhaustive procedures, even if the cryptographic key (3.7) is known

3.15

issuer

institution holding the account identified by the primary account number (PAN) (3.22)

3.16

key component

one of at least two parameters having the format of a cryptographic key (3.7) that is added modulo-2

with one or more like parameters to form a cryptographic key

3.17

modulo-2 addition

exclusive OR-ing

binary addition with no carry

3.18

node

message processing entity through which a transaction passes

3.19

Personal Identification Number

PIN

string of numeric digits established as a shared secret between the cardholder (3.8) and the issuer

(3.15), for subsequent use to validate authorized card usage

3.20

PIN entry device

PED

device providing for the secure entry of PINs (3.19)

Note 1 to entry: Security requirements for PIN entry devices are specified in 5.1.

3.21

plain text

data in its original unenciphered form

3.22

primary account number

PAN

assigned number, composed of an issuer identification number, an individual account identification

and an accompanying check digit as specified in ISO/IEC 7812-1, which identifies the card issuer and

cardholder (3.8)

3.23

primary account number token

PAN Token

surrogate value used in place of the original PAN (3.22) in certain, well-defined situations, but that is

not used in place of the original PAN in every way that the original PAN is used

3.24

pseudo-random number

number that is statistically random and essentially unpredictable although generated by an

algorithmic process

3.25

reference PIN

value of the PIN (3.19) used to verify the transaction PIN (3.30)

3.26

reversible encipherment

transformation of plain text (3.21) to cipher text (3.5) in such a way that the original plain text can be

recovered

3.27

sensitive state

device condition that provides access to the secure operator interface such that it can only be entered

when the device is under dual or multiple control

3.28

split knowledge

condition under which two or more parties separately and confidentially have custody of components

of a single key that individually convey no knowledge of the resultant cryptographic key (3.7)

3.29

terminal

acquirer-sponsored device that accepts ISO/IEC 7813 and ISO/IEC 7816 compliant cards and initiates

transactions into a payments system

Note 1 to entry: It can also include other components and interfaces, such as host communications.

3.30

transaction PIN

PIN (3.19) as entered by the customer (3.8) at the time of the transaction and subsequently transmitted

to an issuer system or submitted to the ICC (3.13) for verification

Note 1 to entry: Verification means comparison to the reference PIN (3.25).

3.31

true random number generator

device that utilizes an unpredictable and non-deterministic physical phenomenon to produce a stream

of bits, where the ability to predict any bit is no greater than 0,5 given knowledge of all preceding and

following bits

4 © ISO 2017 – All rights reserved

4 Basic principles of PIN management

4.1 General

The term “PIN” is used to describe any string of numeric digits established as a shared secret between

the cardholder and the issuer, for subsequent use to validate authorized card usage. The term PIN may

be qualified as “cardholder PIN”, “reference PIN” and “transaction PIN” in the following ways.

a) Issuance:

1) the PIN

i) is generated by the issuer and delivered to the cardholder (as the cardholder PIN), or

ii) is selected by the cardholder and conveyed to the issuer;

2) the issuer stores the PIN as the reference PIN or stores data such that the reference PIN can be

recalculated; the reference PIN may be stored in the issuer system and/or an ICC.

b) Usage:

1) the cardholder enters their PIN into a PED. The PIN, once entered into a PED, is the

transaction PIN;

2) the transaction PIN is transmitted to the issuer or sent to the ICC for comparison with the

reference PIN.

Some requirements pertain to all PINs while other requirements are specific to cardholder PINs,

reference PINs, and/or transaction PINs. Where requirements apply to all PINs, the term PIN is used

without qualification.

4.2 Principles

PIN management shall be governed by the following basic principles.

a) Fraudulent modification or access to the hardware and software used for all PIN management

functions shall be prevented or detected (see 6.1.1).

b) For different accounts, encipherment of the same PIN value under a given encipherment key shall

not produce the same cipher text (see 6.2) except by chance.

c) Security of an enciphered PIN shall not rely on the secrecy of the encipherment design or algorithm,

but on the security of the cryptographic key (see 6.2).

d) A PIN shall not exist outside of a secure cryptographic device (SCD), as defined in 5.1, except in the

following cases:

1) delivery of the PIN to the cardholder using an approved method as defined in 8.3;

2) enciphered using an approved algorithm, as defined in 6.2, in a process that ensures two

accounts with the same PIN do not have the same encrypted value; this process may use PIN

block formats 0 or 3;

3) conveyance of the reference PIN to the ICC to enable offline PIN verification, as defined in 8.9;

4) storage of a reference PIN within an ICC in accordance with 7.3;

5) submission of a transaction PIN to an ICC in accordance with 9.2.2.

e) PIN issuance shall be performed only by personnel authorized by the issuer as defined in 8.3.

f) PIN selection/change shall be performed only by the cardholder as defined in 8.2.4 and 8.5.

g) Management of PIN establishment/change devices shall be performed only by personnel authorized

by the issuer, except as allowed in 8.5. Such personnel shall operate only under strictly enforced

procedures.

h) With the exception of PIN selection/change by mail (see 8.4.4 and 8.5.5), the PIN shall never be

known to, or accessible by, any employee or agent of the institution, not even in the PIN issuing

process.

i) A stored reference PIN shall be protected from unauthorized substitution as defined in 8.9.

j) Compromise of the PIN (or suspected compromise) shall result in the ending of the PIN life cycle as

defined in 8.10.

k) Responsibility for PIN verification shall rest with the issuer as defined in 7.2 and 7.3.

l) Different encipherment keys shall be used to protect the reference PIN and the transaction PIN as

defined in 6.2.

m) The customer shall be advised in writing of the importance of the PIN and PIN secrecy (see Annex C

for guidance).

n) Clear text and/or enciphered transaction PINs shall never be retained. Transaction PINs shall only

exist for the duration of a single transaction (the time between PIN entry and verification, i.e. store

and forward).

o) Any part of a PIN (e.g. individual digit or representations thereof) shall be subject to the same

security requirements as the entire PIN as defined in this document.

For the purposes of this document, an ICC is considered to be part of the issuer’s domain.

5 PIN handling devices

5.1 PIN handling device security requirements

A PIN handling device is a device that handles clear text PINs, e.g. PIN entry device, IC reader and

host security module (HSM), etc. Any additional functionality provided by the device or the system

into which it is integrated shall not impair the security of the device or the PIN entry process. A PIN

handling device, other than an ICC, shall be an SCD meeting the requirements of ISO 13491-1. The

security requirements for an ICC are specified in 7.3.

A PIN entry device shall not rely on tamper evidence as its sole physical security characteristic.

The PIN entry device shall include tamper-detection and response mechanisms which, if attacked,

cause the PED to become immediately inoperable and result in the automatic and immediate erasure of

any secret information that might be stored in the PED, such that it becomes infeasible to recover the

secret information.

The PIN entry device should be able to authenticate itself to the acquirer such that, once compromised,

it is no longer able to authenticate itself to the acquirer. An example method to support this requirement

is where Message Authentication Codes (MAC) are calculated over online transaction messages and the

MAC key is erased if the PIN entry device is attacked.

NOTE Systems supporting online PIN verification typically meet this requirement in that the acquirer

authenticates the validity of the PIN entry device each time a PIN is processed. (The authentication of the PIN

entry device is implicit in the usage of the PIN encryption key.)

The display used to prompt a cardholder to enter their PIN shall be controlled such that modification

and/or improper use of the prompts is not feasible (see ISO 13491-2:2017, Table B.1 number B2 and

Table B.3 number B22).

6 © ISO 2017 – All rights reserved

The card reader shall be protected to prevent unauthorized access, substitution or alteration of the

card data read from the card (see ISO 13491-2:2017, Table B.1 number B3 and Table B.3 number B28).

5.2 Physical security for IC readers

The following requirements are specific to IC readers. The slot of the IC reader into which the ICC is

inserted should

a) not have sufficient space to hold a PIN-disclosing “bug” when a card is in the IC reader,

b) nor be enlarged to provide space for a PIN-disclosing “bug” without detection,

c) nor be positioned such that wires leaving the slot to an external “bug” can be hidden from users of

the device.

5.3 PIN entry device characteristics

5.3.1 Character set

All PIN entry devices shall provide for the entry of the decimal numeric characters zero to nine.

NOTE It is recognized that alphabetic characters, although not addressed in this document, can be used as

synonyms for decimal numeric characters. Further guidance on the design of PIN entry devices, including alpha

to numeric mappings, is given in Annex B.

5.3.2 Character representation

The relationship between the numeric value of a PIN character and the internal coding of that value

prior to any encipherment shall be as specified in Table 1.

Table 1 — Character representation

PIN character Internal binary

0 0000

1 0001

2 0010

3 0011

4 0100

5 0101

6 0110

7 0111

8 1000

9 1001

6 PIN security issues

6.1 PIN control requirements

6.1.1 PIN processing systems

PIN processing systems are systems that process PINs in all stages of the PIN life cycle, e.g. merchant

terminal systems, host application software driving host security modules, and card and PIN

personalization systems, etc.

Systems used in PIN processing shall be implemented in such a way that the following are ensured.

a) The hardware and software are correctly performing their designed function and only their

designed function.

b) The hardware and software cannot be modified or accessed without detection and/or disabling.

c) Information cannot be fraudulently accessed or modified without detection and rejection of the

attempt.

d) The system is not capable of being used or misused to determine a PIN by exhaustive trial and error.

e) Any PIN management device (e.g. host security modules) handling clear text PINs conforms to the

requirements of secure cryptographic devices with PIN management functionality as specified in

ISO 13491-2.

f) Output of any sensitive information used in the selection, calculation or encipherment of the PIN is

controlled during use, delivery, conveyance, submission, transmission, storage and disposal.

g) Except when the PIN is to be sent to the ICC in clear text, the PIN is enciphered immediately upon

entry into the PED.

6.1.2 Recording media

Any recording media containing data from which a plain text PIN might be determined shall be rendered

unreadable or physically destroyed immediately after use in accordance with Annex A.

6.1.3 Oral communications

No procedure shall require or permit oral communication of the plain text PIN, either in person or by a

person over the telephone.

An institution shall never permit its employees to ask a customer to disclose the PIN or to recommend

specific values.

6.1.4 Telephone keypads

Procedures of an institution shall not permit entry of the plain text PIN through a keypad of a telephone

at any time in the PIN life cycle, unless the telephone device is designed and constructed to meet the

requirements specified in 5.1 for PIN entry devices and 9.2 for PIN transmission.

6.2 PIN encipherment

If it is necessary to encipher a PIN (see 9.2), this shall be accomplished using one of the approved

algorithms specified in ISO 9564-2.

Different encipherment keys shall be used to protect the reference PIN and the transaction PIN.

Symmetric PIN encipherment keys may be used in online and offline PIN verification systems.

Symmetric PIN encipherment keys shall not be used for any other cryptographic purpose.

Asymmetric PIN encipherment is only permitted in offline PIN verification systems. Asymmetric PIN

encipherment keys should not be used for any other cryptographic purpose.

The adopted encipherment procedure shall ensure that the encipherment of a plain text PIN value using

a particular cryptographic key does not predictably produce the same enciphered value when the same

PIN value is associated with different accounts.

NOTE A format 2 PIN block does not meet this requirement without additional protection mechanisms.

8 © ISO 2017 – All rights reserved

Key management practices associated with PIN encipherment shall comply with the requirements of

ISO 11568 (all parts).

7 PIN verification

7.1 General

PIN verification is the process whereby a transaction PIN is compared with a reference PIN to determine

whether the two have the same value. Derivatives of the transaction and reference PINs may be used

during the PIN verification process in lieu of the clear text PIN.

7.2 Online PIN verification

Transaction PINs are verified online after secure transmission to the issuer according to 9.2.1.

Responsibility for online PIN verification shall rest with the issuer.

7.3 Offline PIN verification

Transaction PINs are verified offline after submission to the ICC according to 9.2.2. Responsibility for

offline PIN verification shall rest with the issuer through programming/configuration of the ICC which

is under issuer control.

An ICC containing a reference PIN for offline PIN verification shall provide a level of protection against

known attacks on the ICC sufficient to prevent recovery of the plain text reference or transaction PIN or

any other secrets stored within the ICC.

8 Techniques for management/protection of account-related PIN functions

8.1 PIN length

A PIN shall be not less than four and not more than 12 digits in length.

While there is a security advantage to having a longer PIN, usefulness may be hindered. For usability

reasons, an assigned numeric PIN should not exceed six digits in length.

8.2 PIN establishment

8.2.1 PIN establishment techniques

A PIN shall be established using one of the following techniques:

a) assigned derived PIN;

b) assigned random PIN;

c) customer-selected PIN.

8.2.2 Assigned derived PIN

When the reference PIN is an “assigned derived PIN”, the issuer shall derive it cryptographically from

a) the primary account number, and/or

b) some other value associated with the customer.

The PIN derivation process should not contain a bias towards specific sets or values.

8.2.3 Assigned random PIN

When the reference PIN is an “assigned random PIN”, the issuer shall obtain a value by means of either

a) a true random number generator, or

b) a pseudo-random number generator.

These may be achieved using a random number generator compliant with ISO/IEC 18031 and tested

using NIST/SP 800-22.

8.2.4 Customer-selected PIN

When a reference PIN is a “customer-selected PIN”, the value shall be selected by the customer. In this

case, the issuer shall provide the customer with the necessary selection instructions and warnings (see

Annex C for guidance).

8.3 PIN issuance and delivery to the cardholder

Methods used for the issuance and delivery of the PIN to the cardholder shall comply with the following

basic requirements.

a) The plain text PIN shall never be transmitted over communications lines outside of a secure

environment as specified in ISO 13491-2:2017, H.5, unless there is no feasible way in which the PIN

could be related to the cardholder, the cardholder’s account or card.

b) The PIN shall never be known to, or accessible by, any employee or agent of the institution, not even

in the PIN issuing process.

c) All PIN issuance functions involving issuer personnel (including their agents) shall be under dual

control.

d) At no point in the delivery process shall the PIN appear in plain text where it can be associated with

a customer’s account, primary account number (PAN) or PAN Token.